Informative Review: Club Vistara SBI Card PRIME

Club Vistara SBI Card PRIME

Introduction

Are you an avid traveller looking to embark on seamless journeys with exclusive perks and rewards?

Look no further! The Club Vistara SBI Card PRIME is a powerful financial companion that promises to elevate your travel experience.

In this comprehensive review, we’ll delve into the intricacies of this credit card, exploring its features, benefits, and potential drawbacks to help you make an informed decision that aligns perfectly with your lifestyle and travel preferences.

What is Club Vistara SBI Card PRIME?

The Club Vistara SBI Card PRIME is a co-branded credit card that brings together the best of Vistara, one of India’s premier airlines, and SBI Card, a leading credit card issuer. As a travel-centric credit card, it is tailored to cater to frequent flyers and globetrotters’ needs.

Key Features of Club Vistara SBI Card PRIME

Key Features

- Welcome Benefits: 1 Premium Economy ticket( E-Gift Voucher) on the payment of Annual/Renewal Fee.

- Rewards Benefits: Earn 4 CV points per Rs 200 spent on all your spending.

- Complimentary Airport Lounge Access: Enjoy 8 complimentary visits to Domestic Lounges. ( Max: 2 visits per quarter)

- Complimentary Priority Pass Membership: Enjoy 4 complimentary visits to International Lounges. ( Max: 2 visits per quarter)

- Comprehensive Insurance Cover: Avail Air Accidental Insurance worth Rs 1 Crore. Enjoy Lost card liability cover up to Rs 1 Lakh. Also, you can avail of 6 flight cancellations, with each cancellation limited to Rs 3500.

Fees & Charges

| Description | Fees & Charges |

|---|---|

| Joining Fee | Rs 2999 + GST |

| Annual/Renewal Fee | Rs 2999 + GST |

| Add-on Card Fee( per annum) | NIL |

| Interest Charges | 3.5% per month ( 42% per annum) |

| Foreign Currency Markup Charges | 3.5% |

| Fuel Surcharge | 1% on the transaction |

| Annual Fee Waiver | No |

Eligibility Criteria

- It is imperative that the applicant meet the minimum age requirement of 18 years.

- Additionally, the applicant must either be self-employed or salaried and possess a stable income.

- Furthermore, it is essential that the applicant maintain a respectable credit history.

Documents Required

The following documents serve as valid forms of identity proof:

PAN Card, Passport, Voter’s ID, Aadhar Card, and Driving License, among others.

Similarly, acceptable forms of address proof:

the latest month’s utility bills, Passport, Aadhar Card, and any other government-approved address proof.

To provide proof of income, individuals may submit their latest salary slips or bank statements, or alternatively, their latest audited Income Tax Return (ITR).

Benefits of Club Vistara SBI Card PRIME

Earn Rewards Points ~ CV Points

How to earn them?

Cardholders can earn Vistara Points on various transactions(all retail spends) from hotel stays to everyday expenses like grocery shopping and fuel purchases.

4 Club Vistara(CV) Points for each Rs 200 spent

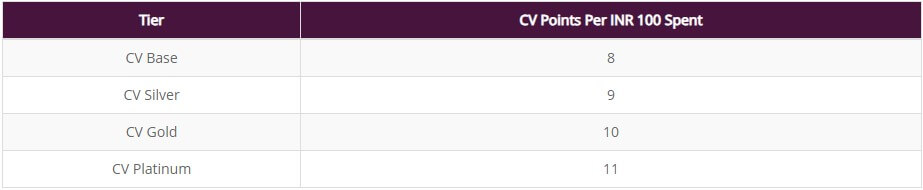

Additionally, you can earn 9 CV points on each Rs 100 spent whenever you book a flight through the Air Vistara portal( as you hold Club Vistara Silver Membership on the card)

Bonus point offers and promotions

The card often features attractive bonus point offers and promotional campaigns, allowing users to accumulate points rapidly.

Accelerated earning opportunities

Specific transactions and spending categories may offer accelerated Vistara Points, enhancing the rewards potential for cardholders.

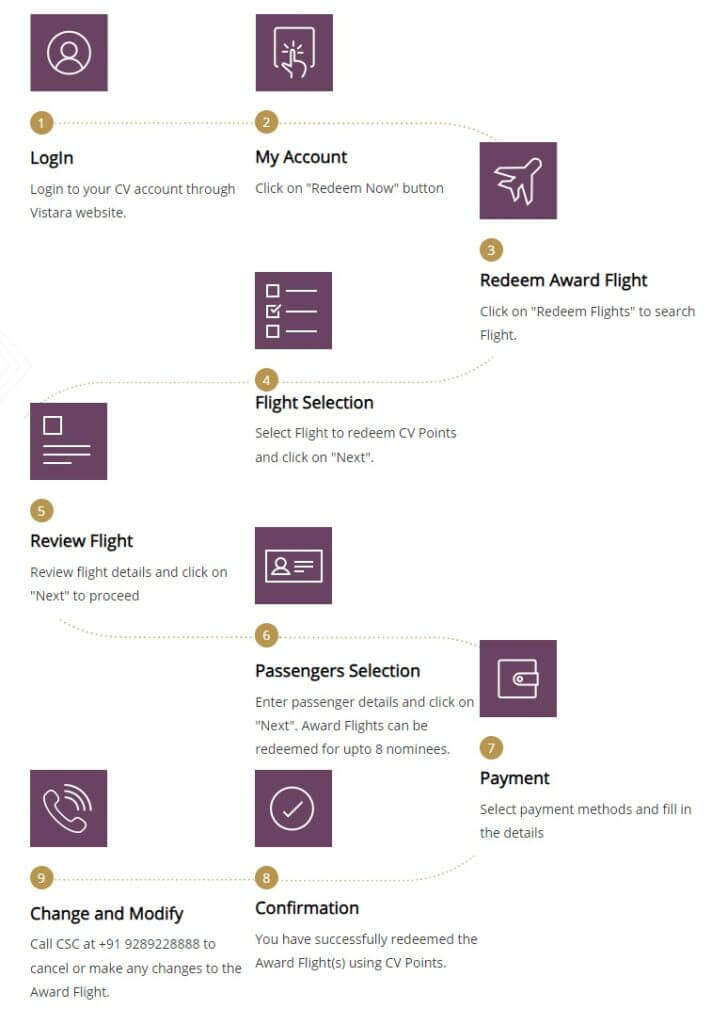

Redemption of CV Points

Vistara flight redemptions

One of the primary draws of the Club Vistara SBI Card PRIME is the ability to redeem Vistara Points for flight tickets, making travel more affordable and enjoyable.

Partner Airline redemptions

Cardholders can also use Vistara Points to book flights with partner airlines, expanding their travel options globally.

Non-travel redemption options

Apart from flights, Vistara Points can be redeemed for various non-travel options, including merchandise, vouchers, and more.

Complimentary Airport Lounge Access

The Club Vistara SBI Card PRIME grants cardholders complimentary access to select airport lounges, providing a comfortable and luxurious pre-flight experience.

| Airport Lounges | No of Visits(Per Quarter) | No of Visits(Per Year) |

|---|---|---|

| Domestic | 2 (max) | 8 |

| International | 2 (max) | 6 |

There are a few important points to remember when using this card for Domestic Lounge access:

- If not used, the complimentary visits will lapse. They will not be carried forward to the next quarter.

- If the cardholder accesses the lounge beyond the authorised complimentary visits for a given quarter, they will be charged the regular fee.

- The complimentary visits are meant for the primary cardholder alone. No exceptions !!

The International Airport Lounge access is provided through Priority Pass program which costs 99$. It is complimentary for the 1st year of the card issuance. From 2nd year onwards, you have to pay 27$ + GST for each visit.

Milestone Rewards

The Club Vistara SBI Card PRIME takes pride in acknowledging and rewarding the loyalty of its esteemed users. With its enticing Milestone Rewards program, every step of your spending journey becomes a stepping stone to an array of exclusive benefits and privileges.

| Amount Spent in a Year | Milestone/Activation Benefits |

|---|---|

| Rs 75,000 | 3000 Bonus CV Points |

| Rs 1,50,000 | 1 Premium Economy ticket |

| Rs 3,00,000 | 1 Premium Economy ticket |

| Rs 4,50,000 | 1 Premium Economy ticket |

| Rs 8,00,000 | 1 Premium Economy ticket & Hotel Gift Voucher worth INR 10,000 |

Conclusion

The Club Vistara SBI Card PRIME is one level above the standard Club Vistara SBI Card, as was to be expected. As a result, we receive better prizes and advantages. The good news is that even with the greater annual subscription, getting the PRIME option is preferable. If we choose this card, we will receive 3 Premium Economy flights after spending Rs 4.5 lakhs. When we spend Rs 5 Lakhs on the base variation, we receive 3 Economy tickets.

Get the Club Vistara SBI Card PRIME even if you intend to spend the same amount.

Please read the other posts:

FAQs

What is the Club Vistara SBI Card Prime?

The Club Vistara SBI Card Prime is a co-branded credit card offered by SBI Card in partnership with Vistara Airlines. It is designed to provide exclusive travel benefits and rewards for frequent flyers.

What are the key benefits of Club Vistara SBI Card Prime?

The card offers a range of benefits, including complimentary Club Vistara Silver membership, milestone rewards, airport lounge access, accelerated reward points on Vistara bookings, fuel surcharge waiver, and more.

How can I apply for the Club Vistara SBI Card Prime?

You can apply for the card online through the SBI Card website or by visiting a local SBI branch. The application process is simple; you must provide the necessary documents and meet the eligibility criteria.

What are milestone rewards, and how do they work with this card?

Milestone rewards are additional benefits or bonuses cardholders can earn by reaching specific spending milestones within a given period. For the Club Vistara SBI Card Prime, these rewards may include bonus Vistara Points or vouchers.

Can I redeem the reward points earned with the Club Vistara SBI Card Prime for flights on other airlines?

The reward points earned with this card are typically redeemable for Vistara flight bookings and other travel-related expenses within the Vistara network. Check the rewards program terms for specific redemption options.

Does the Club Vistara SBI Card Prime offer travel insurance coverage?

Yes, the card often comes with complimentary travel insurance coverage, protecting against travel-related contingencies such as trip cancellation, baggage loss, and medical emergencies. Please refer to the card’s terms and conditions for details.

Is the Club Vistara SBI Card Prime suitable for international travel?

Yes, the card is designed for both domestic and international travel. Cardholders can earn rewards on international transactions and may also enjoy additional benefits when traveling abroad, such as a forex markup fee waiver.