RBL Bank World Safari Credit Card Review

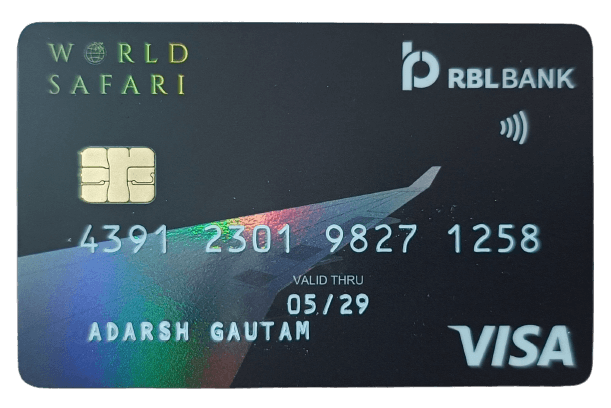

RBL Bank World Safari Credit Card

Overview

The right credit card can make your life easier—and life is too short to spend it struggling with finances.

Welcome to our comprehensive evaluation of the RBL Bank World Safari Credit Card.

In this review, we will examine its main features, benefits, and potential downsides. I aim to provide a simple and easy-to-understand assessment that will help you determine if this card meets your needs.

Regardless of your financial literacy or language proficiency, we have ensured that our review is accessible and user-friendly. We understand the significance of making informed decisions, and we are here to guide you every step of the way.

Let’s explore the world of possibilities that the RBL Bank World Safari Credit Card has to offer. Stay tuned!

At A Glance

RBL Bank World Safari Credit Card

- Joining Fee: Rs 3000 + GST

- Renewal Fee: Rs 3000 + GST

- Best Features: 0% Foreign Currency Markup Fee, Milestone Travel Points, Airport Lounge Access

Fees & Charges

| Description | Fees & Charges |

|---|---|

| Joining Fee | Rs 3000 + GST |

| Renewal Fee | Rs 3000 + GST |

| Add-on Card Fee | NIL |

| Finance charges for both revolving credit & cash advances | APR up to 3.99% p.m. (47.88% p.a.) |

| Cash advance fee | 2.5% of the cash amount (min Rs. 500) |

| Late Payment Fee | 12.5% of Outstanding amount * Min Amount: Rs 5 * Max Amount: Rs 1300 |

| Overlimit Penalty (levied if outstanding exceeds credit limit) | 2.5% of overlimit amount, subject to a minimum of Rs. 500 |

| Fuel Transaction Charge | 1% surcharge on fuel transaction value or Rs.10/- whichever is higher |

| Reward Redemption Fee | Rs. 99 +GST |

| Merchant EMI Processing Fee | Rs. 199+GST |

| Fee on Rental Transactions | 1% fee on transaction amount |

Welcome Benefits

RBL Bank World Safari Credit Card

- MakeMyTrip voucher of Rs 3000/-. Redeem it for flights/hotels/holidays

Eligibility Criteria

Info

- Age: You should be minimum 21 years & maximum 60 years.

- Income: You should have a regular monthly income.

What do you get ?

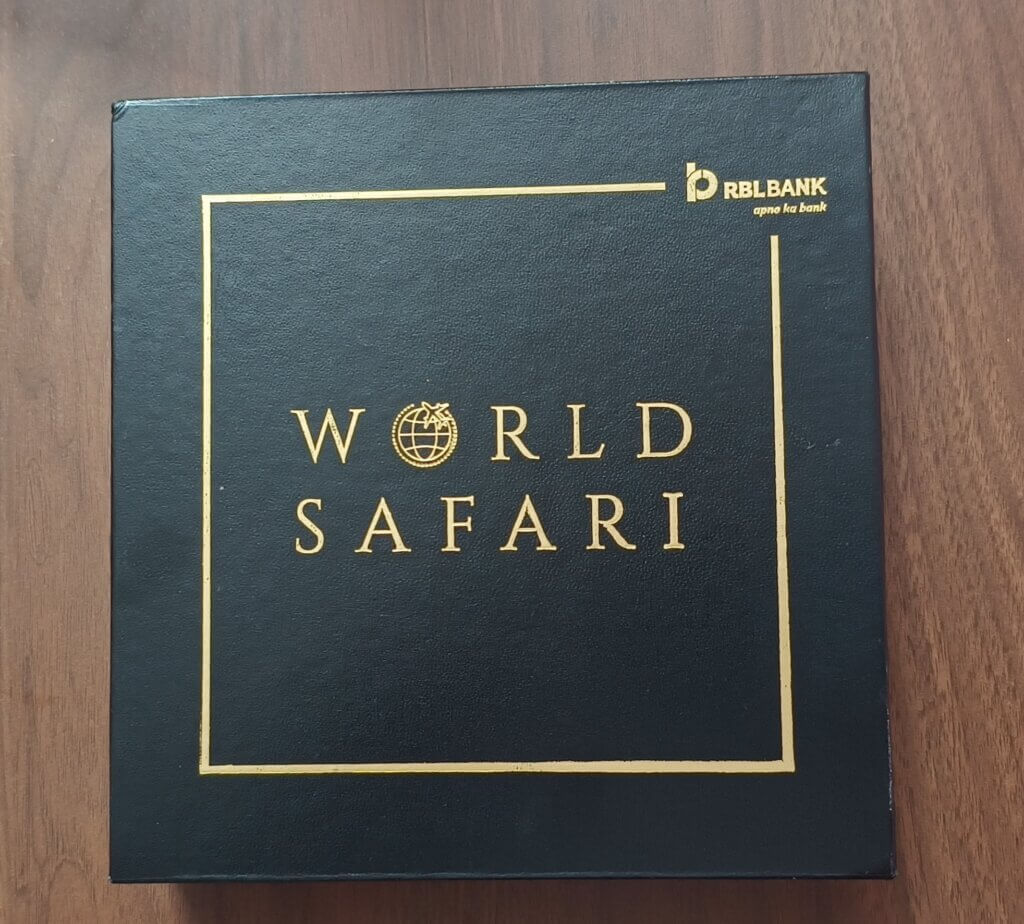

Usually, you would get an envelope that holds all the concerned documents with the credit card. But here, RBL Bank showcases World Safari credit cards as a premium offering. So, a beautiful black colour box with golden ink welcomes you.

The box contains the following things:

How to setup the PIN on new card?

You have to setup the PIN once you recieve the card. As per RBI guidelines, you have to do that within 30 days. Otherwise, your card will be cancelled by the bank.

Please follow these steps for the card activation:

Rewards Programme

Regular Rewards

- For Travel Spends: You earn 5 travel points for every Rs 100/-spent

- For Non-Travel Spends: You earn 5 travel points for every Rs 100/-spent

Milestone Rewards

| Total Spends in a Year | What you will earn !! |

|---|---|

| Rs 2.5 Lakhs | 10,000 Bonus travel points |

| Rs 5 Lakhs | Additional 15,000 Bonus travel points |

| Rs 7.5 Lakhs | A Gift Card worth Rs 10,000/- from the brands like Taj Experiences, Amazon, Croma, Myntra & MakeMyTrip |

For the spending of Rs 7.5 lakhs in a year, you can get benefits worth up to Rs 30,000/-

Visit the below link to explore and redeem your Travel Points for various purchases, such as hotel stays and air travel.

Airport Lounge Access

Travelling can be exhausting, but the RBL Bank World Safari Credit Card aims to make your journey as smooth as possible with its enviable feature – the Airport Lounge Access. This convenience can dramatically transform your travel experience, allowing you to unwind before a hectic flight or during long layovers.

Let’s discuss this Airport Lounge Access, a must-have for frequent flyers. The RBL Bank World Safari Credit Card holders are offered complimentary access to select airport lounges, both domestically and internationally.

Domestic Airports

| Access Type | Complimentary Access in a Quarter ( Max) | Complimentary Access in an Year ( Max) | Access via |

|---|---|---|---|

| Domestic | 2 | 8 | Visa/MasterCard |

International Airports

| Access Type | Complimentary Access in a Quarter ( Max) | Complimentary Access in an Year ( Max) | Access via |

|---|---|---|---|

| International | - | 2 | Priority Pass |

Once you spend Rs 50,000/- in a calendar quarter, you become eligible to enjoy 1 additional complimentary lounge visit

More Travel Benefits

This credit card claims to be the first in the industry to offer 0% Foreign Currency Markup Charges. That means, whatever you transact, will have to pay the exact same amount.

For example:

| Credit Card | You Spend | Extra Charges ( 3.50% Foreign Markup Fee + 18% GST ) | You Pay |

|---|---|---|---|

| Any Other Card | 100$ | 4.13$ | 104.13$ |

| RBL Bank World Safari Credit Card | 100$ | NIL | 100$ |

Complimentary Travel Insurance

When you travel abroad, you want to enjoy the experience and time without hassles. So, the World Safari credit card comes to help you.

Some more details on the policy coverage:

| Description | Detail |

|---|---|

| Policy Period | 1 year |

| No of Trips | Multi-trips ( 1st 3 in a year ) |

| Maximum trip duration | 10 days ( per trip) |

| Coverage | Worldwide including USA & Canada. Exclusion: the country of residence |

The policy cover details are important to know for any individual:

| Description | Detail |

|---|---|

| Entry Age – Minimum | Adult : 18 years |

| Entry Age – Maximum | 60 years |

| Cover Type | Group Explore Cover which includes coverage on Individual basis |

| Eligibility Criteria | Insured Person should be Travel Credit Card Holder of RBL Bank |

| Eligible Relationship | Self |

| Sum Insured | $50,000 |

Golf Privileges

The credit card gives golf privileges to its customers:

Golf Concierge is complimentary only for MasterCard holders.

Please contact the concierge desk for bookings, by calling Customer Service at

022 6232 7777

24/7 Concierge Service

RBL Bank’s World Safari Credit Card offers an exclusive 24/7 Concierge Service catering to the diverse needs of cardholders. Here are the key features of this service:

- Round-the-clock Assistance: Access to a dedicated concierge service available 24/7 to assist with various requests and inquiries.

- Travel Arrangements: Help book flights, hotels, car rentals, and other travel-related services, ensuring a seamless experience.

- Dining Reservations: Assistance in securing reservations at top restaurants globally, offering a diverse culinary experience.

- Event Ticketing: Support acquiring tickets for concerts, sporting events, shows, and more, helping cardholders access exclusive and sought-after events.

- Special Occasions: Assistance in planning and organizing special occasions like anniversaries, birthdays, or other celebrations, ensuring memorable experiences.

- Local Recommendations: Providing recommendations and information about local attractions, shopping spots, and entertainment venues at various destinations.

- Emergency Assistance: Support during emergencies, such as lost card replacement, emergency cash disbursement, and more.

How to Contact?

RBL Bank Credit Card Helpline

SuperCard Helpline

Credit Card Cancellation Request / Sales grievance*

Conclusion

Our journey exploring the RBL Bank World Safari Credit Card has been insightful. Likely appealing to travel enthusiasts and golf lovers, this credit card packs an impressive range of features. From the highly coveted Airport Lounge Access to the game-changing golf privileges it offers, this card caters to your aspirational lifestyle.

Remember, the right credit card can assist you in effectively managing your finances while also upgrading your lifestyle. As we close our comprehensive review, we hope this has clarified if the RBL Bank World Safari Credit Card matches your requirements and lifestyle.

Stay tuned for more in-depth reviews and financial insights. Until then, safe travel, smooth swings, and a savvy financial journey to you all!

Please read the other posts:

FAQs

How can I apply for the RBL Bank World Safari Credit Card?

You can apply for the RBL Bank World Safari Credit Card through the official RBL Bank website or visit a local branch. You’ll need to fulfil specific eligibility criteria and provide the necessary documents for the application.

What are the benefits of Airport Lounge Access?

With Airport Lounge Access, cardholders can avail of complimentary entry to select airport lounges domestically and internationally. These lounges offer comfortable seating, free Wi-Fi, meals, and beverages. It’s an oasis inside bustling airports.

What golf privileges does the card offer?

The RBL Bank World Safari Credit Card offers several golf privileges, including complimentary green fees at select golf courses, free golf lessons, access to premium golf clubs, exclusive discounts on golf merchandise, and invitations to golf tournaments.

Can I earn reward points with the RBL Bank World Safari Credit Card?

Yes, the RBL Bank World Safari Credit Card does offer reward points on particular eligible spends. The specifics are in our review article or the official RBL Bank website.

Remember, always contact RBL Bank for the most accurate and up-to-date information.

What measures should I take if I lose my RBL Bank World Safari Credit Card?

In case of loss or theft of your RBL Bank World Safari Credit Card, immediately report it to RBL Bank’s customer service hotline. They will guide you through the process to block your lost card and issue a replacement.