Indian Oil Axis Bank Credit Card Review

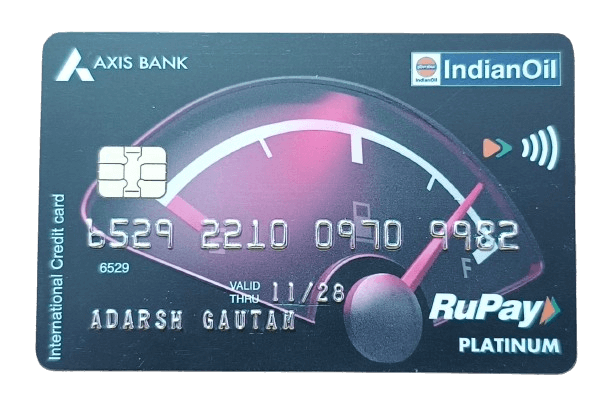

Indian Oil Axis Bank Credit Card

Introduction

Welcome to our insightful review of the Indian Oil Axis Bank Credit Card!

This handy companion for your wallet promises significant savings on fuel expenses, but does it truly deliver?

Stick with us as we unravel its features, including exclusive benefits, applicable charges, reward systems, and more!

Our detailed review will help you assess if this card is your ideal fiscal partner, addressing your doubts in a language that resonates with everyone, experienced or not, in the world of personal finance.

Let’s pave your way to smarter spending, one review at a time!

Quick Look

Indian Oil Axis Bank Credit Card

- Joining Fee: Rs 500 + GST

- Annual Fee: Rs 500 + GST

- Best for: Fuel

- Best Feature(s): Earn EDGE reward points on fuel/online & offline shopping, Fuel Surcharge Waiver

Fees & Charges

| Description | Charges |

|---|---|

| Joining fee | Rs. 500 |

| Annual Fee | 1st Year: NIL 2nd Year onwards: Rs. 500 |

| Add-on card joining fee | NIL |

| Add-on card annual fee | NIL |

| Card replacement fee | NIL |

| Cash payment fee | Rs.100 |

| Duplicate Statement fee | Waived |

| Charge slip retrieval fee or copy request fee | Waived |

| Outstation cheque fee | Waived |

| Mobile alerts for transactions | Free |

| Balance enquiry charges | Waived |

| Finance charges (Retail purchases and cash) | 3.6% per month (52.86% per annum) |

| Cash withdrawal fees | 2.5% (Min. Rs. 500) of the cash amount |

| Overdue penalty or Late payment fees | * NIL if Total Payment Due is less than Rs. 500 * Rs. 500 if total payment due is between Rs. 501 - Rs. 5,000 * Rs. 750 if total payment due is between Rs. 5,001 - Rs. 10,000 * Rs. 1200 if total payment due is greater than Rs.10,000 |

| Over limit penalty | 2.5% of the over limit amount (Min Rs. 500) |

| Cheque return or dishonor fee or auto-debit reversal | 2% of the payment amount subject to Min. Rs.450, Max. Rs. 1,500 |

| Surcharge on purchase or cancellation of railway tickets | As prescribed by IRCTC/Indian Railways |

| Foreign currency transaction fee | 3.5% of the transaction value |

| G.S.T | As per existing government norms |

| Reward Redemption fee | Yes |

| Rent Transaction fee | 1% capped at INR 1,500 per transaction plus taxes |

| Dynamic Currency Conversion markup | 1% plus taxes will be applicable on Axis Bank Credit Cards for each International transaction performed in Indian currency at International location or transactions performed in Indian currency with merchants located in Indian but registered in foreign nation. |

Welcome Benefits

Indian Oil Axis Bank Credit Card

- 100% cashback (up to Rs. 250) on the first fuel transaction made within 30 days of card issuance.

Eligibility Criteria

For Individuals

- The primary cardholder’s age should be between 18 years – 70 years.

- The add-on cardholder should be above 15 years old.

- The individual can be either a Resident Indian or a Non-Resident Indian.

Documents Required

For Individuals

- PAN Card or Form 60

- Colour Photograph

Income Proof(any one of the following)

- Latest Salary Slip

- Form16

- IT return copy

Address Proof(any one of the following)

- Passport

- Ration Card

- Electricity Bill

- Landline Telephone Bill

Identity Proof(any one of the following)

- Passport

- PAN Card

- Driving License

- Aadhar Card

The final decision about your credit card application will be communicated within 21 days, by the bank.

Milestone Benefits

There are no milestone-specific benefits that you see in other credit cards. But yes, if you spend Rs 50,000 a year, the renewal fee for the next year will be waived.

Are all transactions considered eligible for this wave-off?

Simple Answer: No !!

There are a few transactions that the bank has excluded from the list of spending that will not be counted when availing of an annual fee waiver:

EDGE Reward Points

How to earn?

* There is a minimum spend of Rs 100 & maximum spend of Rs 5000 for fuel spending & online shopping in a given month.

How to Redeem?

This credit card is designed to reward users for their everyday spending. After accumulating many of these points, you can redeem them to enjoy a range of offers and goods.

Once you have enough points, go to Axis Bank’s EDGE rewards catalogue online and offline and choose a reward you’d like to redeem your points. This could include fuel vouchers, lifestyle products, travel benefits, etc.

Fuel Surcharge Waiver

Fuel surcharge waiver is one of the critical benefits of the Indian Oil Axis Bank RuPay Credit Card. It’s designed to help you save more on your fuel expenses.

Whenever you purchase fuel at any Indian Oil Corporation Limited (IOCL) outlets across India with your Indian Oil Axis Bank RuPay Credit Card, you get a complete waiver on the 1% fuel surcharge.

But, do you know, how to avail this benefit? Let me tell you:

- Purchase Fuel: Use your card to buy fuel at any IOCL outlet.

- Automated Waiver: The fuel surcharge waiver is automatically applied to your account. You don’t need to do anything to claim it!

- Check Your Statement: You’ll see the waived amount reflected there when you receive your credit card statement.

This feature allows you to save every time you refuel. However, remember there’s a maximum limit to the surcharge waiver per month

Remember, this fuel surcharge waiver benefit is available only after a minimum spending of Rs 200 and a maximum of Rs 5000 in a given month.

Dining Delights

The Indian Oil Axis Bank Credit Card offers an exciting feature known as ‘Dining Delights.’ As the name suggests, it’s designed to make your dining experience more delightful with attractive discounts.

Avail up to 15% discount on selected restaurants via EazyDiner

BookMyShow Offer

Avail up to 10% instant discount on movie tickets booked via the BookMyShow app or website ( Maximum discount per card per month is Rs 100)

You have to find and apply the ongoing offer from the “Offers” section of the BookMyShow app or website.

Extra Perks

Avail exciting discounts on MakeMyTrip, Grofers, Goibibo & Tata Cliq every Wednesday.

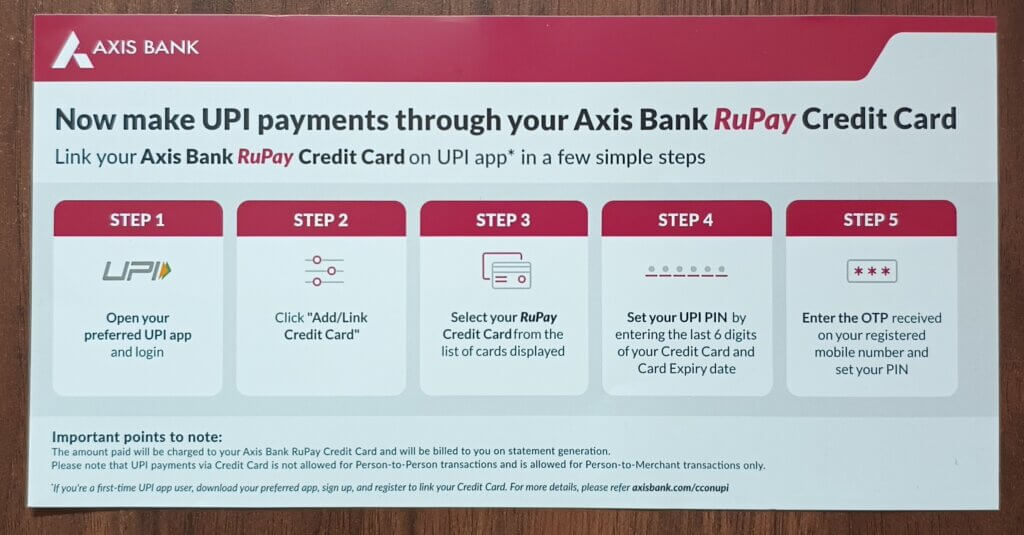

UPI Payments

Can you make UPI payments through this credit card?

Yes !!

And, for that, you have to link your Indian Oil Axis Bank Credit Card on UPI app by following these steps:

Conclusion

And there you have it!

Our comprehensive review of the Indian Oil Axis Bank Credit Card.

The card offers significant value, especially for those who hit the road frequently. Its attractive fuel surcharge waivers and impressive rewards program make it an ideal companion for all those travelling miles. And remember the Dining Delights for those who love exploring new cuisines.

But as always, our final advice is to assess your personal needs and spending habits. Understanding these will guide you in making a well-informed decision.

Please read other interesting posts:

FAQs

What is the Indian Oil Axis Bank Credit Card?

The Indian Oil Axis Bank Credit Card is a credit card designed with savings benefits, especially for regular customers of Indian Oil Corporation Limited. It provides surcharge waivers on fuel purchases and offers rewards through its EDGE rewards program.

How does the fuel surcharge waiver work on this credit card?

Each time you use the Indian Oil Axis Bank RuPay Credit Card at an Indian Oil Corporation Limited outlet for fuel purchase, you’re entitled to a 1% fuel surcharge waiver. The waived amount will be reflected in your credit card statement.

How can I earn and redeem EDGE Reward Points on this card?

You earn EDGE Reward Points whenever you make purchases using your Indian Oil Axis Bank RuPay Credit Card. You can redeem these points for various rewards such as fuel vouchers, lifestyle goods, travel benefits, and more through Axis Bank’s EDGE rewards catalogue.

How does the Dining Delights feature work?

The Dining Delights program offers at least 15% off at select partner restaurants across India via EazyDiner when you pay using the Indian Oil Axis Bank RuPay Credit Card.

How can I check my EDGE Reward Points balance?

You can check your EDGE Reward Points balance by logging in to Axis Bank’s internet banking service or mobile app or looking at your monthly credit card statement.