Swiggy HDFC Bank Credit Card Review

Swiggy HDFC Bank Credit Card

Overview

Hello and Namaste!

I hope you’re having a good day. We’re here today to discuss something helpful for all our foodies. If you always order in or love to eat out often, what if I told you there is a way to make it more rewarding?

Exactly, we are discussing a way to save a little more on each delicious meal you order. This is the Swiggy HDFC Bank Credit Card we’re busting. We’re hoping.

Have you ever heard of it? Perfect, if not – don’t worry, we’ve got you covered. We’ve rolled our sleeves to dive deep into what this card offers. We thought it was fair to review it only for our fellow Indians who love a good meal as much as a good deal.

Keep reading as we unfold everything you need to know about the Swiggy HDFC Credit Card, taking it from just another name you’ve heard, something that might be your next best friend. Bear with us; read this simple article ending with Perhaps you are considering owning this card.

Grab a snack, and let’s get started. Shall we?

Take A Glance

Swiggy HDFC Bank Credit Card

- Joining Fee: Rs. 500 + GST

- Annual Fee: Rs. 500 + GST

- Best for: Food Delivery & Dining

- Reward Type: CashBack

- Best Feature(s): Swiggy One membership, CashBack on Online Spends across specific MCC.

Fees & Charges

| Description | Fees & Charges |

|---|---|

| Joining Fee | Rs 500 + GST |

| Renewal/Annual Fee | Rs 500 + GST |

| Spend Based Waiver | Waiver on spending Rs 2 Lakhs per annum |

| Add-on Card Fee | NIL |

| Reward Redemption Fee | NIL |

| Foreign Currency Markup Charges | 3.5% |

| Fuel Transaction Charges | N/A |

| Interest Rates | 3.6% per month or 43.2% per annum |

Welcome Benefits

Swiggy HDFC Bank Credit Card

- Complimentary Swiggy One membership for 3 months

Eligibility Criteria

For Salaried Indian nationals

- Age: Minimum 21 years & Maximum 60 years

- Net Monthly Income should be greater than Rs 15,000

For Self-Employed Indian nationals

- Age: Minimum 21 years & Maximum 65 years

- Annual Income Tax Return (ITR) should exceed Rs 6 Lakhs.

How to Activate the Card?

First things first, we need to bring your new foodie friend to life — your credit card! You can pick from several methods to activate it:

- Kick-start with a Purchase: Go ahead and make any transaction using your credit card. It could be anything from a small chocolate to a big feast; you decide.

- OTP & IVR: If you’re tech-savvy, you can get started using the OTP (One-Time Password) method or the good old IVR (Interactive Voice Response).

- PIN Generation: Setting up the PIN for your card is like choosing the perfect spices for your biryani — essential and personal. Do this to activate your card.

- Fine-tune Online Controls: Do you prefer extra cheese or no onion in your orders? Just like that, you can personalize your card controls — turn online transactions on or off, give a green signal to international transactions, and more!

Now, if you’re scratching your head thinking about where to start, chill! Just click on the below button for help:

Complimentary Swiggy One Membership

Indeed, let’s spice up our conversation with some savoury data that illustrates the flavour-packed value of the Complimentary Swiggy One Membership that comes with the Swiggy HDFC Bank Credit Card.

Here’s the data feast that shows why this combination is as irresistible as your favourite dish:

Unlimited Free Deliveries

As a Swiggy One member, enjoy unlimited free deliveries on orders above Rs 149 from various restaurants, translating into significant savings.

Let’s assume you order food 4 times a week, with a delivery charge of Rs 30 per order. Over a month that saves Rs 480 just on delivery!

No Surge Fees

Members are exempt from surge pricing. Surges can add approximately 10-20% to your order cost during peak hours.

Say goodbye to those additional charges, especially beneficial during the rainy season or festive days when you crave comfort food the most.

Exclusive Discounts

Enjoy up to 30% off on select restaurants exclusively for Swiggy One members.

If you typically spend Rs 2000 monthly on eating out, a 30% discount racks up Rs 600 in savings.

Let’s break this down over a year:

| Description | Expenses |

|---|---|

| Delivery Savings | Rs 480 x 12 months = Rs 5,760 |

| Surge Fee Savings | Let's conservatively estimate this at Rs 100 a month = Rs 1,200 a year |

| Discount Savings | Rs 600 x 12 months = Rs 7,200 |

| Total Savings | Rs 14,160 |

Remember that the actual savings could vary based on your ordering habits. Still, even with conservative estimates, the numbers highlight a tasty proposition. These savings, combined with the convenience of priority service, make the Complimentary Swiggy One Membership not just a card perk but a lifestyle upgrade for every food enthusiast.

How to claim the membership?

Did you get your credit card activated?

Great! Now, to claim that Swiggy One Membership, all you need is a bit of patience as the magic unfolds.

- Wait for 2-3 days after activating your card. Why the wait? Well, think of it as marinating your chicken before grilling it to perfection. It’s all about the flavour, my friend.

- Once the waiting period ends, whip out your phone and open the Swiggy app.

- There, you’ll see the option to claim your ‘Swiggy One’ membership. Go on, claim it, and feel like the VIP you now are.

Exciting CashBacks

Let’s sprinkle some factual seasoning onto our discussion about the Swiggy HDFC Bank Credit Card to give you a clearer picture of how much you could save and earn in cashback. I’m serving you some hot, freshly prepared data to feast your financial appetite on!

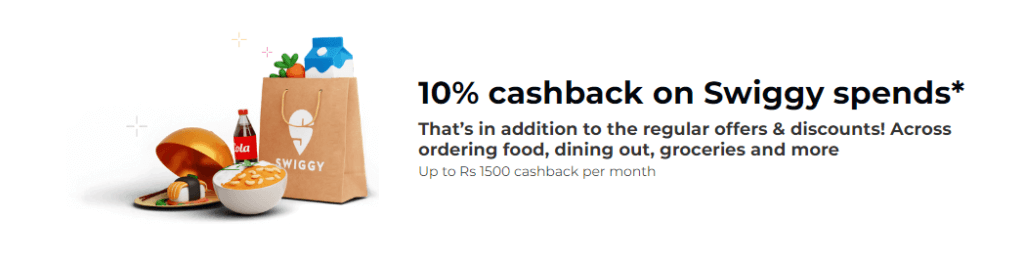

10% CashBack on Swiggy Spends

Every time you whip out your Swiggy HDFC Card to settle that food bill, fill your pantry with groceries, or indulge in some fine dining, you’re not just paying; you’re also earning a delectable 10% cashback. And I’m not just talking about one-time wonders, but every single time you use Swiggy.

Monthly CashBack Limit

You can earn a maximum of Rs 1500/- per month

10% CashBack on Online Spends

Alright, my online shopping lovers and app addicts, let’s have a little heart-to-heart. We know the undeniable joy of hitting that ‘Order Now’ or ‘Add to Cart’ button, right?

Whether snagging the latest gadget, refilling your skincare stash, or even getting your weekly groceries online, the satisfaction is unparalleled. But what if I told you that your shopping spree could come with rewards?

Enter the Swiggy HDFC Bank Credit Card, bringing more fun to the party with a fabulous 5% cashback on all your online spending.

Monthly CashBack Limit

You can earn a maximum of Rs 1500/- per month

1% CashBack on Other Spends

This isn’t just about the big, flashy online purchases. It’s about every day, the essentials, and yes, even those last-minute “oops, I did it again” buys.

Whether you’re dining out, grabbing groceries from the store next door, or even hopping onto other food and grocery apps because, let’s face it, variety is the spice of life, the Swiggy HDFC Card has got your back with a 1% cashback on all these spends.

Monthly CashBack Limit

You can earn a maximum of Rs 500/- per month

Do you want to calculate your savings?

Swiggy has a “Savings Calculator” which gives you an idea of how much you will save every month.

CashBack Exclusions?

Yes, there are certain exclusions that you have to keep in mind.

From Any CashBack

Rent, Utilities, Fuel, Insurance, EMI, Jewelry, Govt spends, Wallet loads & similar spends

From 5% CashBack

Flight, hotel bookings & others

Premium Golf Club Access

You’re in for a treat as a Swiggy HDFC Bank Credit Card holder. Some of the most exclusive golf clubs in the country are now within your reach. How often have you strolled past a golf club, wishing to walk into the lush, sprawling greens and spend a day under the open skies?

12 free golf lessons/year in India

Or you’re new to the sport, and you’ve always fantasized about picking up the clubs. Well, it’s time you turned those dreams into reality!

Now, who’s up for a round of golf? 🌞⛳️🏌️♂️

Hotel Discounts on Agoda

An exciting hotel stay doesn’t have to mean emptying your bank balance—especially not when you’re armed with a Swiggy HDFC Bank Credit Card, the perfect partner for your travels.

Instant 12% discount on hotel bookings worldwide through Agoda. You heard it right—it’s not just within India, but anywhere you fancy across the globe.

Conclusion

In wrapping up our journey through the perks and privileges of the Swiggy HDFC Bank Credit Card, it’s clear this card is a pocket dynamo for those who love the finer things in life but are savvy about how they get them.

From the rewarding cashback on online splurges and daily essentials, premium golf club access, to sweet deals on worldwide stays via Agoda, this card is your ticket to a lifestyle upgrade without the eye-watering expense usually attached.

Please read other interesting posts:

FAQs

How does the cashback system work for the Swiggy HDFC Credit Card?

For every purchase you make, you get a certain percentage of cashback. The exact percentage depends on the spend category, with some special categories (like dining or Swiggy orders) offering higher cash back.

Can you get discounts on all hotels with the Swiggy HDFC Bank Credit Card, or are there restrictions?

The card offers up to 12% instant discount on hotel bookings worldwide via Agoda. However, it’s always a good idea to check if there are any specific exclusions or terms that apply.

Who should consider applying for the Swiggy HDFC Bank Credit Card?

If you’re someone who frequently orders from Swiggy or travels and stays in hotels, this card could offer significant value. It’s also suitable for those who enjoy lifestyle benefits like dining out and playing golf.