How to Close Axis Bank Credit Card

- Overview

- Ways to close the Axis Bank Credit Card

- Online Method(s)

- Offline Method(s)

- Things to Remember Before Closing an Axis Bank Credit Card

- RBI Guidelines on Credit Cards Closure

- Are there any consequences?

- Can Axis Bank cancel your Credit Card?

- How to Reactivate a Closed Axis Bank Credit Card

- Conclusion

- FAQs

Overview

Are you tired of juggling multiple credit cards and looking to close one finally? Or you’ve decided to bid farewell to your Axis Bank Credit Card for a different reason. No worries!

Closing a credit card can feel daunting, especially when you need help figuring out where to start. Worry not! With our highly engaging and reader-friendly guide on “How to Close Axis Bank Credit Card,” we’ve got you covered.

We’ve made sure this article goes beyond just presenting facts. Woven into our guide are personal experiences and a touch of warmth that makes navigating the credit card closure landscape feel like a walk in the park. Whether you’re a finance expert or a concerned cardholder, our post is an easy-to-understand manual designed for everyone, regardless of language barriers.

So please sit back, relax, and let’s embark on this journey together to understand the ins and outs of closing your Axis Bank Credit Card!

Ways to close the Axis Bank Credit Card

Closure Methods

- Online: via Email

- Offline: via Customer Care, via Visiting Nearest Axis Branch

Let’s see these different closing methods in detail:

Online Method(s)

Close Axis Bank Credit Card via Email

Offline Method(s)

Additionally, to close your Axis Bank credit card offline, contact their customer service hotline or visit a nearby branch.

Close Axis Bank Credit Card by Visiting Nearest Axis Branch

You can visit your nearest Axis Bank branch to cancel your credit card. Please bring a valid form of identification and your active Axis Bank credit card for the card cancellation process.

Close Axis Bank Credit Card via Customer Care

Axis Bank’s Credit Card Customer Care

- 1860 419 5555

- 1860 500 5555

- 1800-103-5577 (toll-free)

You can contact customer care, mentioned above, using your registered mobile number to request a cancellation. The representative will ask you a few identity verification questions and proceed with closing your Axis Bank credit card account.

Things to Remember Before Closing an Axis Bank Credit Card

Closing a credit card might seem like a simple task, but it comes with its own set of considerations.

Here are some key points to remember before closing your Axis Bank credit card:

1. Clear All Dues

Make sure to clear all your pending dues before you proceed. Any outstanding balances can lead to penalties and also negatively impact your credit score.

2. Redeem Reward Points

Remember your hard-earned reward points. Redeem all your reward points before closing your credit card, as you might lose them once it is closed. Axis Bank offers many options for redeeming these points, from travel vouchers to shopping discounts.

3. Check for any EMI Plans

If you have any ongoing EMI plans associated with your card, ensure to clear them or transfer them to another credit card. Closure of cards with active EMIs may lead to additional charges or even default.

4. Update Auto-Payments

In case you have any auto-debits or automatic payments linked to your Axis Bank credit card, remember to update these payment details to avoid late fees or service interruptions.

5. Obtain a No Dues Certificate

Once all dues are cleared, request a No Dues Certificate or a closure statement from Axis Bank. This document acts as a validation that all dues on your card have been settled.

6. Verify the Card Closure

People often assume their card is closed once they have paid off the balance. However, getting written or official confirmation from Axis Bank is essential. Ensure you follow up until you have proof that the card has been closed.

7. Monitor Your Credit Score

Closing a credit card can influence your credit score. Keep an eye on it in the months following your card closure to ensure it is not adversely affected.

RBI Guidelines on Credit Cards Closure

| Guidelines | Description |

|---|---|

| 1 | Credit cards will be closed within 7 working days of raising a closure request. However, closure will only occur if the cardholder has paid off any outstanding amounts. |

| 2 | In the event of failure to close a card account after a customer has requested closure, credit card issuers will be liable to pay a daily fine of Rs. 500. |

| 3 | If a card remains unused for a year, the issuer will deactivate it and notify the user. The account will be closed if the cardholder responds within 30 days. |

| 4 | Card issuers must offer multiple channels for submitting closure requests, including mobile banking, online banking, a helpline, an IVR, a dedicated email address, and a mobile app. |

| 5 | If the cardholder still has available credit, it should be transferred to their bank account. |

Credit card issuers must notify the credit bureau within 30 days of closure.

Are there any consequences?

Yes, there are !!

Closing a credit card is a significant financial decision that should not be taken lightly. There may be positive and negative consequences that you should be aware of before proceeding.

Below are the possible consequences of closing your Axis Bank credit card.

1. Impact on Credit Utilization Ratio

Closing a credit card can influence your credit score. Keep an eye on it in the months following your card closure to ensure it is not adversely affected.

2. Affect Credit History

Closing a credit card can influence your credit score. Keep an eye on it in the months following your card closure to ensure it is not adversely affected.

3. Loss of Reward Points

Closing a credit card can influence your credit score. Keep an eye on it in the months following your card closure to ensure it is not adversely affected.

4. Disruption of Automatic Payments

Closing a credit card can influence your credit score. Keep an eye on it in the months following your card closure to ensure it is not adversely affected.

5. Reduction of Financial Flexibility

Closing a credit card can influence your credit score. Keep an eye on it in the months following your card closure to ensure it is not adversely affected.

It’s advisable to understand and weigh these factors before closing your Axis Bank credit card account. Your decision should align with your short-term and long-term financial goals.

Always strive for informed and responsible financial decision-making.

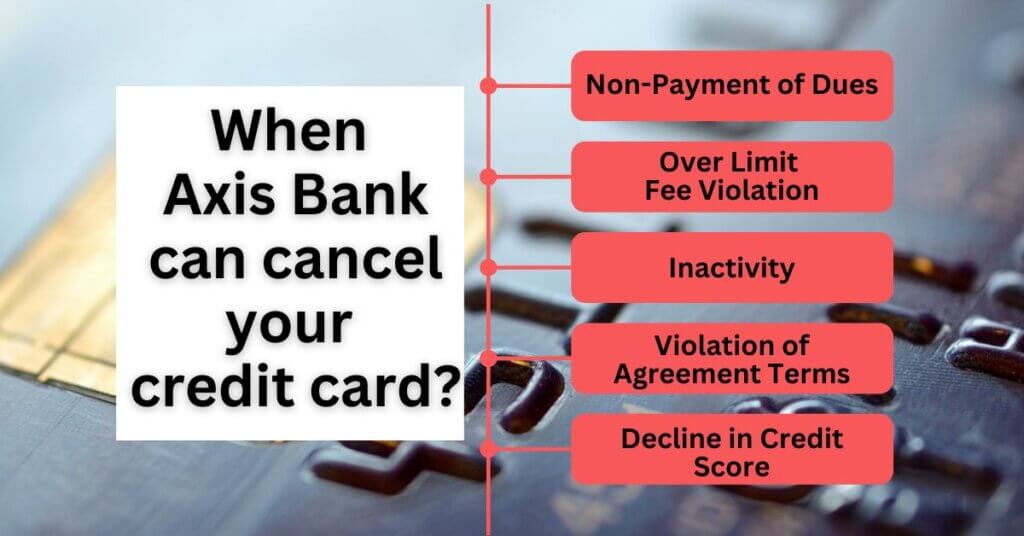

Can Axis Bank cancel your Credit Card?

In simple words, Yes !!

The cancellation of a credit card can happen for various reasons. While it’s within a customer’s rights to close their credit card account, banks like Axis Bank can cancel your credit card under certain circumstances.

Here are some reasons why Axis Bank can cancel your credit card:

1. Non-Payment of Dues

If you don’t make your credit card payments on time or if you default on your payments, Axis Bank may cancel your card. Late payment or non-payment jeopardizes your credit score and signals to the bank that you may be a credit risk.

2. Over Limit Fee Violation

Frequently exceeding your credit card limit signifies financial instability or poor budget management. Axis Bank might perceive this as credit risk behaviour and could decide to cancel your credit card.

3. Inactivity

If your Axis Bank credit card is unused for an extended period, the bank may cancel it. This is because inactive cards do not generate revenue but still cost the bank to maintain the account.

4. Violation of Agreement Terms

Violating the terms and conditions, as stated in the cardholder’s agreement with Axis Bank, might result in the cancellation of your credit card. This can include fraudulent activity, using the card for prohibited purposes, or providing false information to the bank.

5. Decline in Credit Score

A significant decline in your credit score can also lead to the cancellation of your credit card by Axis Bank. A lower credit score represents a high credit risk to the bank.

Safe and responsible use of your credit card ensures the continuation of your credit card account and helps enhance your credit history.

Always adhere to the terms and conditions set out by Axis Bank to maintain a healthy financial relationship with the bank.

How to Reactivate a Closed Axis Bank Credit Card

Understanding how to reactivate a closed Axis Bank credit card can be helpful, especially when reconsidering closing your account.

How to Reactivate?

- Contact Axis Bank

- Provide Necessary Documentation

- Understanding the Cause

- Timing Matters

However, it is essential to note that the reactivation process is only sometimes straightforward and may depend heavily on why the credit card was closed.

Here are a few steps to reactivate your closed Axis Bank credit card:

1. Contact Axis Bank

Contact Axis Bank through their customer care number or visit your nearest branch. Inform them that you want to reactivate your credit card and ask what steps are necessary.

2. Provide Necessary Documentation

Axis Bank may request specific documentation, such as proof of address, proof of income, and identity verification, to reevaluate your creditworthiness. Be ready to provide these documents promptly.

3. Understanding the Cause

If the credit card was closed due to missed payments or violation of terms and conditions. In that case, the bank might be reluctant to reactivate it. In this case, you should make any outstanding payments or rectify any breaches.

4. Timing Matters

As a general rule, it is easier to reactivate a credit card if it has been open for a while. If the closure was recent, you stand a higher chance of getting your credit card reactivated.

Each situation is unique, and there’s no guarantee that an account can permanently be reopened.

However, maintaining good financial habits and regular communication with your bank can enhance your chances of a positive outcome.

Remember to manage and use your credit card responsibly at all times.

Conclusion

In closing, getting to grips with “How to close Axis Bank credit card” can be a breeze. This guide has walked you through a stress-free process to accomplish just that. Remember, clearing any outstanding dues is crucial, and consult with Axis Bank’s customer service where necessary.

Understanding how to manage your credit cards effectively can boost your financial health exponentially. Stay informed, stay empowered, and take control of your banking journey!

Please read the other posts:

FAQs

How to close Axis Bank credit card?

You can close your Axis Bank Credit Card by paying your dues, calling customer service, and following the procedure they provide for card cancellation.

Is there any fee for closing the Axis Bank Credit Card?

No, there is no fee for closing the Axis Bank Credit Card. However, ensure that all dues, outstanding payments, and EMIs are cleared before closing.

Will closing my Axis Bank Credit Card affect my credit score?

As long as you have cleared all your dues before cancellation, closing the card should not negatively impact your credit score.

How long does closing the Axis Bank Credit Card take?

Once you inform the bank and follow their process, the card should be closed within 7-10 working days.

What should I do if I face problems while closing my Axis Bank Credit Card?

If you experience any difficulties during the card closure process, contact Axis Bank’s customer service immediately. They can guide you through your issue and provide suitable solutions.