Ultimate Review: HDFC Regalia Credit Card

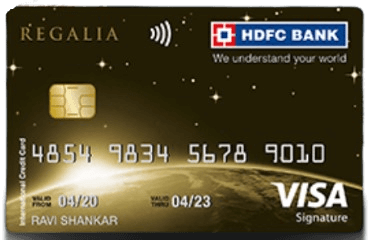

HDFC Regalia Credit Card

- Introduction

- What is HDFC Regalia Credit Card?

- Who is HDFC Regalia Credit Card suitable for?

- Benefits of using HDFC Regalia Credit Card

- HDFC Regalia Credit Card Features and Rewards

- Pros and Cons of HDFC Regalia Credit Card

- Application and Approval Process for HDFC Regalia Credit Card

- Fees & Charges

- Tips and Tricks to Maximize HDFC Regalia Credit Card Benefits

- Conclusion

- FAQs

Introduction

The HDFC Regalia Credit Card is a highly sought-after credit card offered by HDFC Bank. It is designed to cater to the needs of high-net-worth individuals and frequent travellers who seek exclusive benefits.

With its premium features and rewards, the HDFC Regalia Credit Card stands out among its competitors.

What is HDFC Regalia Credit Card?

The HDFC Regalia Credit Card is a prestigious card that offers cardholders a wide range of benefits.

It provides access to many lifestyle and travel privileges, making it an ideal option for individuals who value luxury and personalized experiences.

This card is highly esteemed for its extensive reward program that allows users to earn and redeem points across various categories.

Who is HDFC Regalia Credit Card suitable for?

HDFC Regalia Credit Card

The HDFC Regalia Credit Card suits individuals with a high income or solid financial standing. It caters to those who frequently travel and seek exclusive benefits and privileges. This card perfectly fits individuals who enjoy luxury and want to leverage their spending for rewards and perks.

Benefits of using HDFC Regalia Credit Card

Extensive reward program

The HDFC Regalia Credit Card offers a comprehensive rewards program that allows users to earn reward points on their everyday transactions. These points can be redeemed for diverse options, including air miles, hotel stays, gift vouchers, and more.

Travel privileges

Cardholders of HDFC Regalia Credit Card enjoy various travel benefits such as complimentary airport lounge access, exclusive travel offers, discounts on flight bookings, and travel insurance coverage. It enhances the overall travel experience and ensures peace of mind while on the go.

High-end luxury privileges

The HDFC Regalia Credit Card provides access to exclusive privileges such as discounts at luxury hotels, concierge services, access to premium events, golf privileges, and more. These benefits enhance the lifestyle of the cardholders and offer them an elite experience.

HDFC Regalia Credit Card Features and Rewards

Membership and eligibility criteria

To be qualified for the HDFC Regalia Credit Card, individuals must meet specific income criteria and have a good credit history.

The bank sets specific standards to ensure the card is available to individuals who can utilize its benefits.

Credit limit and card variants

HDFC Regalia Credit Card offers a generous credit limit based on the individual’s income and creditworthiness. The card also comes in different variants, such as Regalia First and Regalia ForexPlus, providing options that serve the unique needs of diverse customers.

Welcome bonuses and reward points

Upon successfully acquiring the HDFC Regalia Credit Card, customers are often welcomed with attractive bonus reward points. These points serve as a head start to maximize the card’s benefits and rewards, amplifying the overall value proposition.

Travel benefits and lounge access

One of the primary advantages of owning the HDFC Regalia Credit Card is its access to premium airport lounges. Cardholders can relax and enjoy complimentary refreshments and amenities while waiting for their flights.

Additionally, the card offers benefits like airport transfers, priority check-ins, and discounts on flight bookings.

Insurance coverage and protection

HDFC Regalia Credit Card offers comprehensive insurance coverage, including travel insurance, air accident insurance, and other protection plans.

These insurance policies provide cardholders coverage against various risks, ensuring peace of mind during travel or unforeseen circumstances.

Dining and lifestyle rewards

Cardholders of HDFC Regalia Credit Card can enjoy dining privileges such as discounts and offers at select partner restaurants.

These benefits extend to other lifestyle categories like shopping, entertainment, and wellness, providing an all-encompassing reward experience tailored to the cardholder’s preferences.

High-end luxury privileges

The HDFC Regalia Credit Card offers a range of high-end luxury privileges to enhance the cardholder’s lifestyle. These include access to premium events, exclusive offers on luxury brands, personalized services, and more.

The card provides an avenue for individuals to indulge in luxury and uniqueness.

Pros and Cons of HDFC Regalia Credit Card

Pros

- Wide range of rewards and benefits

- Extensive travel privileges and airport lounge access

- Comprehensive insurance coverage

- High-end luxury privileges and concierge services

- Dining and lifestyle rewards

- Generous credit limit

Cons

- High annual and renewal fees

- Eligibility criteria can be stringent for some individuals

- Foreign transaction fees can be costly for frequent international travellers

Application and Approval Process for HDFC Regalia Credit Card

How to apply for HDFC Regalia Credit Card?

To apply for the HDFC Regalia Credit Card, individuals can visit the HDFC Bank website or a nearby branch. The bank provides an online application process that requires filling out relevant personal and financial details for assessment.

Documentation requirements

Along with the application form, individuals must submit certain documents, including proof of identity, address, income, and photographs.

The requirements may differ based on the applicant’s profile and the bank’s policies.

Approval process and timeframes

Once the application is submitted along with the required documents, the bank will review the information provided and assess the applicant’s financial capability.

The approval process can take a few days to weeks, depending on various factors.

Fees & Charges

| Description | Fees & Charges |

|---|---|

| Joining Fee | Rs 2500 + Applicable taxes |

| Annual/Renewal Fee | Rs 2500 + Applicable taxes ( Spend Rs 3 Lakhs in 12 months to get fee waiver for the next year ) |

| Foreign Currency Markup Charges | 2% ( Currency conversion rate is applicable as on the date of settlement ) |

| Fuel Transaction Surcharge | Waiver capped at ₹500 every billing cycle |

| Railway Ticket Purchase Fee | 1% of the transaction amount + GST |

| Charges on overlimit account: | 2.5% of overlimit amount, subject to a minimum of Rs 550 |

| Rewards Redemption Fee | Rs 99 Per redemption request |

| Add-on Card Fee | Life Time Free |

Tips and Tricks to Maximize HDFC Regalia Credit Card Benefits

Strategies to earn more reward points

To make the most of the HDFC Regalia Credit Card’s reward program, cardholders can strategize their spending to earn maximum reward points.

It involves utilizing the card for daily purchases, paying bills, and taking advantage of bonus points on specific categories.

Utilizing travel benefits effectively

By understanding the travel benefits offered by the HDFC Regalia Credit Card, individuals can optimize their travel experiences.

This includes taking advantage of complimentary lounge access, discounted flight bookings, travel insurance coverage, and the card’s other perks.

Optimizing insurance coverage

Cardholders can optimize the insurance coverage provided by the HDFC Regalia Credit Card by understanding the terms and conditions of the policies.

This includes knowing the coverage limits, claiming procedures, and utilizing the benefits during travel or unforeseen events.

Getting the most out of luxury privileges

To fully leverage the high-end luxury privileges of the HDFC Regalia Credit Card, cardholders can stay updated on exclusive offers, personalized services, and events.

Individuals can enhance their lifestyles and enjoy unique experiences by using these privileges.

Hacks to save on fees and charges

To minimize the impact of fees and charges associated with the HDFC Regalia Credit Card, individuals can follow specific hacks such as timely bill payments, avoiding cash advances, managing credit utilization, and staying aware of the latest fee structures.

Conclusion

The HDFC Regalia Credit Card stands out for its wide range of benefits, travel perks, and comprehensive rewards. However, potential cardholders must assess their financial circumstances and lifestyle preferences to determine if the HDFC Regalia Credit Card aligns with their needs and goals.

Ultimately, the HDFC Regalia Credit Card is an excellent choice for individuals seeking exclusivity, luxury, and personalized experiences in their credit card journey.

Please read the other posts:

FAQs

How can a user check their reward points balance?

To check the reward points balance on the HDFC Regalia Credit Card, users can access the HDFC net banking portal or mobile app. Alternatively, cardholders can contact HDFC customer support for assistance.

Can I convert reward points into cash?

HDFC Regalia Credit Card allows users to convert reward points into cash, gift vouchers, or other redemption options. The specific conversion process and terms may vary, and cardholders can explore the HDFC rewards catalogue for available options.

What is the process for redeeming reward points?

Cardholders can redeem their reward points through the HDFC rewards catalogue by choosing from various options such as flight bookings, hotel stays, electronics, gift vouchers, and more. The redemption process can be done online or through customer support.

Are there any limitations on lounge access?

While the HDFC Regalia Credit Card offers complimentary access to select airport lounges, certain limitations may apply. These limitations can include location-specific lounge access, a maximum number of visits per year, or accompanying guest charges. Users should refer to the card’s terms and conditions for complete details.

How can I contact HDFC Regalia Credit Card customer support?

Cardholders can contact HDFC Regalia Credit Card customer support through the bank’s dedicated customer service helpline, available on the HDFC Bank website and through the mobile app. The customer support team can help with queries, concerns, and card-related inquiries.