11 Best Debit Cards In India

- Introduction

- 1. ICICI Bank Coral Paywave International Debit Card

- 2. HDFC Bank RuPay Premium Debit Card

- 3. Kotak Bank PayShopMore International Chip Debit Card

- 4. Axis Bank Burgundy Debit Card

- 5. SBI Platinum International Debit Card

- 6. IDBI Visa Signature Debit Card

- 7. Bank of India RuPay Platinum Debit Card

- 8. IDFC First Visa Signature Debit Card

- 9. HDFC Bank Millenia Debit Card

- 10. HSBC Premier Platinum Debit Card

- 11. Standard Chartered Priority Infinite Debit Card

- Conclusion

- FAQs

Introduction

Looking to amp up your financial game?

Spice up your wallet with some plastic magic. We’ve curated the Ultimate Top 11 Debit Cards in India that are your passport to a world of benefits. Exceptional rewards, extensive global acceptance, attractive cashbacks, and more are just a swipe away. Dive in now and unleash the high roller in you!

Transform the way you spend, starting today!

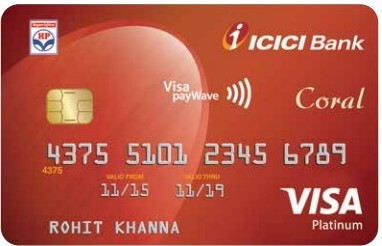

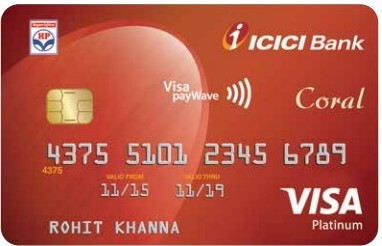

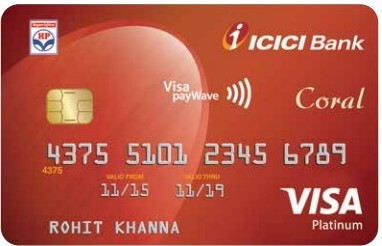

1. ICICI Bank Coral Paywave International Debit Card

| Description | Fees & Charges |

|---|---|

| Joining fee | Rs 599 + 18% GST |

| Annual Fee | Rs 599 + 18% GST ( From 2nd year onwards ) |

| Card Re-issuance Fee | Rs 200 + 18% GST |

| Rewards Redemption Handling Fee | Rs 99 + 18% GST |

| Withdrawal Limits | Domestic: Rs 1,00,000 International: Rs 2,00,000 |

ICICI Bank Coral Paywave Card is a Visa Paywave debit card, the most secure card in India. The card offers international transactions for online buyers to maintain their lifestyle and travel.

Bank customers can collect points for online purchases and discounts on merchants’ shops.

Key Features

- Buy 1 Get 1 Movie Tickets: Applicable at Big Cinemas or INOX when booked via BookMyShow.

- Rewards Program: Earn 6 PAYBACK points for every Rs 200 spent.

- Dining Discounts: Avail 15% off on dining at selected Indian restaurants through Culinary Treats Programme.

- Fuel Surcharge Waiver: Enjoy a 2.5% waiver on fuel surcharge at select HPCL outlets on a minimum spend of Rs 401.

- Complimentary Lounge Access: Free access to airport lounges.

If you are interested in this card and want to know more about it –

| Product | Do you find it interesting? | |

|---|---|---|

| ICICI Bank Coral Paywave International Debit CardPopular card from ICICI Bank

| Let’s Explore !! |

2. HDFC Bank RuPay Premium Debit Card

| Description | Fees & Charges |

|---|---|

| Annual Fee | Rs 200 + GST |

| Replacement / Reissuance charges | Rs 200 + GST |

| ATM Pin Generation | Rs 50 + GST |

| Cross-Currency Mark-up Charges | 3.5% + Applicable taxes |

HDFC Bank RuPay Premium Debit Card is the best for online Indian transactions. It provides a high purchase limit and is suitable for transacting on Indian eCommerce websites. You can also charge this card to interact with sites outside of India.

This card offers many benefits that can make your life easier. It provides a facility to make electronic payments without carrying around cash or using a credit card.

You can withdraw money from participating banks and ATMs.

Finally, the card has many safety features, including fraud protection and 24/7 customer support.

Key Features

- Utility Bill Cashback: Get 5% cashback on utility bill payments.

- Lounge Access: Enjoy complimentary airport lounge access twice per quarter.

- Café Coffee Day Vouchers: Receive welcome vouchers at Café Coffee Day.

- Discounts on Swiggy & Amazon Pay: Avail 20% off on Fridays.

- Personal Accident Cover: Get up to Rs.10 lakh accelerated personal accident death cover.

- Fuel Surcharge Waiver: Enjoy zero fuel surcharge.

If you are interested in this card and want to know more about it –

| Product | Do you find it interesting? | |

|---|---|---|

| Very Good card from HDFC Bank

| Let’s Explore !! |

3. Kotak Bank PayShopMore International Chip Debit Card

| Description | Fees & Charges |

|---|---|

| Joining Fee | Rs 250 + GST |

| Annual Fee | Rs 250 + GST |

| Card Replacement Fee | Rs 250 + GST |

| Foreign Currency Markup Charges | 3.5% |

| ATM Withdrawal | Domestic Rs 40,000 International: Rs 50,000 |

Kotak Bank PayShopMore Debit card comes with many customer-oriented features. The debit card is usable at 30 lakh stores around the country for cash-free and convenient shopping.

You can conveniently use it both on mobile apps and through a website.

This card can be used online and offline to make payments, check balances, or withdraw cash.

Key Features

- High Purchase Limit: Daily purchase limit of Rs 200,000.

- Year-round Offers: Get offers on dining, shopping, travel, etc.

- Accidental Death Cover: Personal accidental death coverage of up to Rs. 5,00,000.

- Purchase Protection: Up to Rs. 50,000 coverage against purchases.

- Lost Card Liability: Coverage of up to Rs. 2,50,000 for lost card.

If you are interested in this card and want to know more about it –

| Product | Do you find it interesting? | |

|---|---|---|

| Kotak Bank PayShopMore International Chip Debit CardPremium card from Kotak Bank

| Let’s Explore !! |

4. Axis Bank Burgundy Debit Card

| Description | Fees & Charges |

|---|---|

| Joining Fee | NIL (For Burgundy customers) |

| Annual Fee | NIL (For Burgundy customers) |

| ATM Withdrawal Limit (Per Day) | Rs 3,00,000 |

| POS Limit per day | Rs 6,00,000 |

| Personal Accident Insurance Cover | Rs 15,00,000 |

| Airport Lounge Access | Yes |

Axis Bank provides you with the best credit card, superior wealth management and savings options.

It gives the perfect banking experience that includes everything from commercial to personal banking needs.

Axis Bank is here to present you with the Burgundy World Debit Card to offer some of the most exclusive privileges, benefits and advantages not taken by other cards.

Key Features

- eDGE Loyalty Rewards: Earn 6 eDGE reward points on each international transaction of Rs 200 or more.

- International Transaction Rewards: Gain 2 eDGE points for every international transaction of Rs 200 or above.

- Movie Tickets Offer: Complimentary tickets available via BookMyShow.

- Airport Lounge Access: Gain complimentary access to airport lounges.

- Dining Discounts: Enjoy a minimum 20% discount at partner restaurants through the Dining Delights program.

If you are interested in this card and want to know more about it –

| Product | Do you find it interesting? | |

|---|---|---|

| Axis Bank Burgundy Debit CardPremium offering from Axis Bank

| Let’s Explore !! |

5. SBI Platinum International Debit Card

| Description | Fees & Charges |

|---|---|

| Joining Fee | Rs 300 + GST |

| Annual Fee | Rs 250 + GST |

| Card Replacement Fee | Rs 300 + GST |

| Cash Withdrawal Limit | Rs 1,00,000 |

| Purchase Limit | Rs 2,00,000 |

| International Usage Facility | Yes |

When looking for a safe and convenient way to manage your finances, look no further than the SBI Platinum International Debit Card. It offers a variety of benefits, including safety and convenience.

The card is issued by one of the world’s leading banks, and it comes with a host of security features to keep your information safe.

Plus, you can use the card to make payments at over 2 million locations worldwide.

So whether you’re looking for a new financial option or want to improve your overall security, the SBI Platinum International Debit Card is a great choice.

Key Features

- Reward Points: Earn 1 reward point for every Rs 200 spent.

- Activation Bonus: Get 200 bonus points for the first 3 purchase transactions.

- Birthday Benefits: Earn 2X reward points on birthday spends.

- Lounge Access: Complimentary access to airport lounges.

- Global ATM Access: Use the card at all ATMs around the world.

If you are interested in this card and want to know more about it –

| Product | Do you find it interesting? | |

|---|---|---|

| SBI Platinum International Debit CardPremium card from SBI

| Let’s Explore !! |

6. IDBI Visa Signature Debit Card

| Description | Fees & Charges |

|---|---|

| Joining Fee | Rs 150 + GST |

| Annual Fee | Rs 799 + GST |

| Add-on / Additional Card | Rs 799 + GST |

| Card Replacement Fee | Rs 799 + GST |

| Physical PIN Request | Rs 50 + GST |

Suppose you’re looking for a reliable, convenient, and affordable method of shopping. In that case, the IDBI Visa Signature Debit Card may be the perfect choice for you.

This card offers a variety of benefits that can make your life easier, including 24/7 customer support, fraud protection, and a wide range of payment options.

Plus, with minimal joining and annual fees, it’s easy to see why many people choose it as their go-to debit card.

Key Features

- High Cash Withdrawal: Daily cash withdrawal limit of Rs 3,00,000.

- Large Purchase Limit: Daily purchase limit of Rs 5,00,000.

- Loyalty Points: Earn 3 points for every Rs 100 spent.

- Lounge Access: Enjoy 4 complimentary airport lounge visits per quarter.

If you are interested in this card and want to know more about it –

| Product | Do you find it interesting? | |

|---|---|---|

| IDBI Visa Signature Debit CardPremium offering from IDBI Bank

| Let’s Explore !! |

7. Bank of India RuPay Platinum Debit Card

| Description | Fees & Charges |

|---|---|

| Joining Fee | Rs 200 + GST |

| Annual Fee | Rs 200 + GST |

| Card Replacement Fee | Rs 500 + GST |

Suppose you’re looking for a debit card that’s both convenient and user-friendly; the Bank of India RuPay Platinum Debit Card is a great option.

The card has an embedded chip that allows you to make purchases quickly and easily. Additionally, use it at any ATM or merchant that accepts debit cards.

The card has many benefits, including free bank transfers and discounts on travel and entertainment.

If you’re looking for a debit card that’s both convenient and user-friendly, the Bank of India RuPay Platinum Debit Card is a great option.

Key Features

- ATM Transaction Limit: Daily limit of Rs 50,000 for both domestic and international ATM transactions.

- Lounge Access: Complimentary airport lounge access for 2 visits per quarter.

- POS Transaction Limit: Daily limit of Rs 1,00,000 for domestic and international POS transactions.

If you are interested in this card and want to know more about it –

| Product | Do you find it interesting? | |

|---|---|---|

| Bank of India RuPay Platinum Debit CardVery good card from Bank of India

| Let’s Explore !! |

8. IDFC First Visa Signature Debit Card

| Description | Fees & Charges |

|---|---|

| Annual Fee | NIL* ( For existing customers ) Rs 499 + GST ( Who became customers post 30th June, 2022) Note: if AMB of Rs 25,000 is not maintained by the existing customers, then, Rs 100 + GST |

| Card Replacement Fee | NIL* ( For existing customers ) Rs 199 + GST ( Who became customers post 30th June, 2022) Note: if AMB of Rs 25,000 is not maintained by the existing customers, then, Rs 100 + GST |

| Daily ATM Withdrawals | Rs 2,00,000 |

| Daily Purchases Limit | Rs 6,00,000 |

After the IDFC bank merger with Capital First, customers have an exciting offer. The new IDFC First savings account comes with their signature Visa debit card.

Suppose you’re looking for a stylish and convenient debit card with various features. In that case, the IDFC First Visa Signature Debit Card is worth considering.

This card offers many benefits that make it a popular choice among consumers. First, it comes with various protections, including fraud monitoring and 24/7 customer support.

Finally, there’s no annual fee associated with this card( for the existing customers at least) and a minimal fee for the new customers post-30 June 2022. This feature makes it an excellent value for those looking to manage their finances responsibly.

Key Features

- ATM Transaction Limit: Daily limit of Rs 2,00,000 for ATM transactions.

- POS Transaction Limit: Daily limit of Rs 6,00,000 for POS transactions.

- Activation Offer: Enjoy 10% cashback on the 1st transaction of Rs 1,000 or more.

- Lounge Access: Receive two complimentary airport lounge visits per quarter.

If you are interested in this card and want to know more about it –

| Product | Do you find it interesting? | |

|---|---|---|

| IDFC First Visa Signature Debit CardVery good card from Bank of India

| Let’s Explore !! |

9. HDFC Bank Millenia Debit Card

| Description | Fees & Charges |

|---|---|

| Annual Fee | Rs 500 + GST |

| Card Replacement Fee | Rs 200 + GST |

| Charge Slip Retrieval Fee | Rs 100 + GST |

| ATM PIN Generation Fee | Rs 50 + GST |

| Cross-Currency Markup Charges for Foreign Transactions | 3.5% + Applicable taxes |

A credit card has more benefits when it comes to rewards and types of transactions. Still, there are some situations where we cannot use a credit card, which is when a debit card is helpful. Some debit cards also offer transaction rewards, so look at the Millennia debit card from HDFC Bank.

Suppose you are looking for a debit card with great features and high levels of security. In that case, the HDFC Millenia Debit Card is definitely worth considering. With its rotating zero liability feature, this card provides peace of mind for those worried about being held responsible for unauthorized charges.

The card has many other impressive features, such as online and mobile banking, fraud monitoring, and global reach.

Key Features

- Annual Discounts: Benefit from discounts up to Rs 4,800 per year.

- Cashback on PayZapp & SmartBuy: Earn 5% cashback points on shopping.

- Online Spends Cashback: Receive 2.5% cashback points on all online purchases.

- Offline Spends & Wallet Reloads: Get 1% cashback points on offline transactions and wallet reloads.

- Lounge Access: Enjoy one complimentary airport lounge visit per quarter.

If you are interested in this card and want to know more about it –

| Product | Do you find it interesting? | |

|---|---|---|

| HDFC Bank Millenia Debit CardTop card from HDFC Bank

| Let’s Explore !! |

10. HSBC Premier Platinum Debit Card

| Description | Fees & Charges |

|---|---|

| Annual Fee | NIL |

| Add-on Card Fee | NIL |

| Card Replacement Fee | NIL ( within India ) NIL ( outside India ) |

| Daily ATM Cash Withdrawal Limit | Rs 2,50,000 |

| Daily Purchase Transaction Limit | Rs 2,50,000 |

The HSBC Premier Debit Card is a great way to improve your finances. It has features perfect for those who want to improve their credit score, make more money, and manage their money more efficiently. Plus, the card has a low-interest rate, so you won’t have to worry about paying high-interest rates on your loans.

HSBC is a global company, that provides you with the opportunity to use your debit card in any of the countries where HSBC is present.

The HSBC Premier Platinum debit card would be worth investigating if you’re looking for an exclusive card with a high transaction limit.

Key Features

- Global Acceptance: Use the card worldwide.

- ATM Withdrawal Limit: Daily limit of Rs 2,50,000 for cash withdrawals.

- Purchase Transaction Limit: Daily limit of Rs 2,50,000 for purchases.

- Dining Privileges: Exclusive dining benefits in Mumbai, Bangalore, Delhi, and Kolkata.

- Concierge Services: 24/7 international assistance.

- Insurance Coverage: Receive up to Rs 5,00,000 in insurance cover.

If you are interested in this card and want to know more about it –

| Product | Do you find it interesting? | |

|---|---|---|

| HSBC Premier Platinum Debit CardExcellent card from HSBC Bank

| Let’s Explore !! |

11. Standard Chartered Priority Infinite Debit Card

| Description | Fees & Charges |

|---|---|

| Joining Fee | NIL |

| Annual Fee | NIL |

| Card Replacement Fee | Rs 200 + GST |

| Daily ATM Cash Withdrawal Limit | Rs 2,00,000 |

| Daily Purchase Transaction Limit | Rs 2,00,000 |

Suppose you’re looking for a card with excellent value for your money and various extra benefits. In that case, the Standard Chartered Priority Infinite Debit Card is definitely worth considering.

This card is perfect for people who frequently use plastic to make purchases, as it has unlimited borrowing and spending capabilities.

The Standard Chartered Priority Infinite Debit Card should be at the top of your list when looking for an affordable and reliable card. It will give you everything you need.

Key Features

- Reward Points: Earn 2x points for every Rs 100 spent without any cap.

- Movie Discounts: Save 50% (up to Rs 300) on BookMyShow movie tickets.

- Air Accident Cover: Insurance coverage of Rs 1,00,000 for air accidents.

- Purchase Protection: Protection up to Rs 55,000 on purchases.

- Lounge Access: Enjoy 4 complimentary airport lounge visits per quarter.

If you are interested in this card and want to know more about it –

| Product | Do you find it interesting? | |

|---|---|---|

| Standard Chartered Priority Infinite Debit CardExcellent card from SC Bank

| Let’s Explore !! |

Conclusion

Ready to upgrade your wallet and reap the rewards?

Discover the perfect match for your spending habits from our handpicked list of the 11 Best Debit Cards in India. Swipe smarter! Click here and start experiencing exceptional value, unprecedented convenience, and lucrative benefits like never before.

Make your next swipe count!

Please read other interesting blogs:

FAQs

Can I make an online purchase using a debit card?

They are all contactless debit cards, which allow you to use EMV chips, PIN technology, and NFC. Also, most of these cards have an app that you can use on your smartphone or tablet, which will provide you with a virtual debit card number that is free to access.

Is it safe to use a debit card in India?

In general, debit cards can be a safer option in India as it is less likely for your card details to be stolen than credit cards. However, this is not always the case.

Can I own a debit card without having a bank account?

No, debit cards are not meant to be used without a bank account. Many people find the link between a debit card and a bank account helpful for budgeting.

Can we get rewards for spending on debit cards in India?

Some cards offer rewards, but not all of them (please go to the individual card reviews for more details). Some cards might reward you even if you don’t spend every day. Like credit cards, some debit cards might be more rewarding than others.