American Express Platinum Travel Credit Card Review

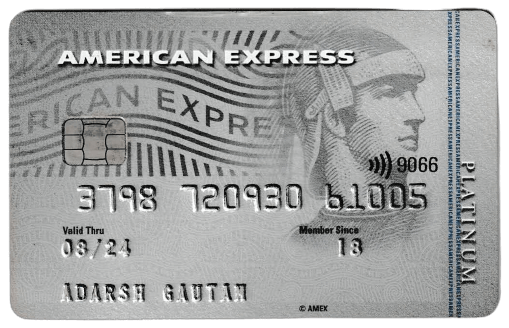

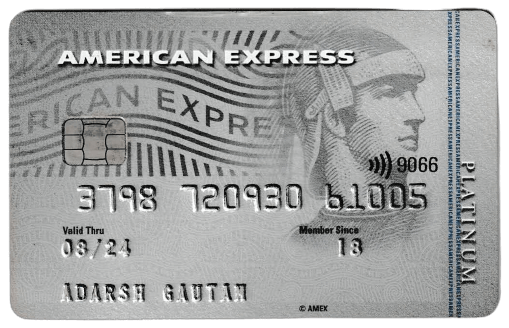

American Express Platinum Travel Credit Card

Introduction

Are you ready to take your wanderlust to new heights while enjoying exclusive perks and benefits?

The American Express Platinum Travel Credit Card may be your golden ticket to an unforgettable journey. In this comprehensive review, we’ll dive deep into the world of this premium travel card, uncovering its advantages and drawbacks so you can make an informed decision that suits your travel aspirations.

Whether you’re a globetrotter seeking luxury experiences or a savvy traveller looking to maximize your savings, this review will provide the necessary insights.

Join us on this exploration of the American Express Platinum Travel Credit Card. Let’s embark on a journey of discovery together.

At A Glance

American Express Platinum Travel Credit Card

- 1st Year Fee: Rs 3500 + GST

- 2nd Year Onwards: Rs 5000 + GST

- Best For Travel

- Unique Feature: If you spend 4 Lacs a year with your card, you’ll score a sweet Taj Stay voucher worth 10,000! You can use it at any Taj, SeleQtions, or Vivanta Hotel.

Currently, an offer is going on to get this card with ” No 1st Year Fee“. Also, you will earn 2,000 Membership Reward Points.

Fees & Charges

| Description | Fees & Charges |

|---|---|

| 1st Year Annual Fee | Rs 3500 + GST |

| 2nd Year Onwards Annual Fee | Rs 5000 + GST |

| Foreign Currency Markup Charges | 3.5% of the transaction amount |

| Add-On Card Fee | * NIL for 2 cards. * Rs 1500 per card thereafter. |

| Fuel Surcharge Fee | * No fuel surcharge at HPCL fuel stations for transactions of up to Rs. 5,000. * 1% surcharge on transactions above Rs. 5,000 |

| Interest Charges | 3.5% per month. |

| Rewards Redemption Fee | NIL |

Welcome Benefits

- You earn a whopping 10,000 bonus Membership Rewards points just by spending Rs. 15,000 within the first 90 days of becoming a card member. But that’s not all!

- Redeem these incredible 10,000 Membership Rewards Points for a fantastic Flipkart voucher or use the Pay with Points option on the American Express® Travel Online platform, giving you a value of Rs. 3,000.

Eligibility Criteria

Rewards Programme

As a cardholder, you’ll earn 1 Membership Rewards Point for every Rs. 50 you spend (excluding fuel, insurance, utilities, cash transactions, and EMI conversion at the point of sale).

So go ahead and treat yourself to that fancy dinner or splurge on a new outfit – every purchase gets you one step closer to amazing rewards!

Milestone Benefits

Benefits of Spending Rs 1.90 Lakhs in a Membership Year

- With 15,000 Membership Rewards Points at your fingertips, you can now treat yourself to an amazing Flipkart voucher or choose the pay with points option on the incredible American Express® Travel Online Platform. That’s not all!

- Get an extra 3,400 Regular Membership Rewards Points, which you can redeem for a fabulous voucher or enjoy some fantastic travel benefits worth Rs. 1,020.

Benefits of Spending Rs 4 Lakhs in a Membership Year

- With 25,000 Membership Rewards Points, you can redeem a Flipkart voucher or use the pay with points option on American Express® Travel Online and get a whopping Rs. 7,500 worth of benefits. But wait, there’s more!

- You also get an additional 3,600 Regular Membership Rewards Points that you can redeem for vouchers or travel benefits worth Rs. 1,080. And that’s not all!

- You’ll also receive a Taj Stay voucher worth Rs. 10,000 that you can use at Taj, SeleQtions, and Vivanta Hotels.

Reward Points Redemption

Unlock a world of possibilities with Amex’s Membership Rewards Points!

Imagine being able to shop on popular e-commerce websites like Flipkart, all while enjoying the benefits of your hard-earned points.

With just a few clicks, you can redeem these points for e-vouchers through Amex’s convenient online shopping portal, INSTA purchases at your favourite offline stores, or even use them to pay off your credit card bills under the exciting Cash + Points scheme.

But that’s not all!

Amex understands that your wanderlust knows no bounds. They’ve partnered with various prestigious air miles and hotel loyalty programs. Now, you can transfer your Membership Rewards Points to programs like:

Air Miles Programs

- Asia Miles

- British Airways Executive Club

- Club Vistara

- Emirates Skywards

- Etihad Guest

- Finnair Plus

- InterMiles

- Qatar Privilege Club

- Singapore KrisFlyer

- Virgin Points

Hotel Loyalty Programs

- Marriott Bonovoy

- Hilton Honors

Travel Benefits

The American Express Platinum Travel Credit Card might be your ticket to an extraordinary adventure. Packed with many travel benefits, this card is designed to make your journeys smoother, more enjoyable, and cost-effective.

Let’s embark on a journey of discovery as we explore the fantastic travel perks of the American Express Platinum Travel Credit Card.

Airport Lounge Access

Picture this: You’re at the airport, and instead of battling the crowded terminal, you find yourself in an oasis of tranquillity – an airport lounge.

With this card, you can access a global network of exclusive lounges. Enjoy complimentary refreshments, comfortable seating, and even shower facilities.

| Airport Lounges | No of Visits (Per Quarter) | No of Visits (Per Year) | Network |

|---|---|---|---|

| Domestic | 2 (max) | 8 | American Express |

| International | - | - | Priority Pass |

Whether you’re travelling for business or leisure, these lounges provide a serene escape from the hustle and bustle of the airport.

American Express Platinum Travel Credit Card does not give you complimentary access to Amex Proprietary Lounges in Delhi & Mumbai.

For international travel, you will get a complimentary membership of Priority Pass worth $99.

Exclusion in Priority Pass

- You must pay a usage fee of $35+GST for every international lounge visit.

- Only the “membership” is complimentary; the access fee is not complimentary.

Complimentary Hotel Stays

When you’re on the road, where you rest your head matters.

With this card, you often receive complimentary nights at luxury hotels and resorts.

Imagine unwinding in a posh suite or basking in the elegance of a world-class resort, all without reaching for your wallet.

Travel Insurance Coverage

Safety is paramount when travelling.

The American Express Platinum Travel Credit Card offers robust travel insurance coverage, including trip cancellation insurance, baggage protection, and emergency medical assistance. It’s like having a safety net that follows you wherever you go.

Rewarding Frequent Flyer Miles

Earn reward points for every dollar spent, which you can redeem for flights, upgrades, or even hotel stays. The more you travel, the more you earn. It’s a win-win!

Global Assistance

Sometimes, unexpected situations arise during travel. With 24/7 global assistance, you have a lifeline wherever you are. American Express has your back if you need help with lost passports, medical emergencies, or travel arrangements.

Dining Benefits

Indulge your taste buds while saving money.

Many restaurants worldwide offer discounts and special privileges to American Express Platinum Travel Credit Cardholders. Enjoy exciting discounts of up to 20% on the selected restaurants.

Savour local cuisine and international flavours without breaking the bank.

Fuel Surcharge Waiver

The incredible 0% convenience fee on fuel purchases under Rs. 5,000 at HPCL Petrol Pumps!

Yes, you heard it right: There are absolutely no extra charges on your fuel fill-ups.

But wait, there’s more!

For those who like to go big, there is a fantastic deal for fuel purchases of Rs. 5,000 and above.

Just a tiny 1% convenience fee, and you’re good to go!

So, whether you’re a regular commuter or planning a long road trip, HPCL Petrol Pumps have covered you with unbeatable convenience and prices.

Hurry up and make the most of this incredible offer!

Platinum Services

Get ready to embark on a journey like no other with the American Express Platinum Travel Credit Card!

Brace yourself for an extraordinary experience where unmatched service is just a call away, 24 hours a day, 7 days a week.

Whether you explore the bustling streets of Tokyo or lounge on a pristine beach in Bali, the Platinum Assist and Emergency Card Replacement services have your back, no matter where you may be.

So, leave your worries behind and let us handle any unexpected hiccups. With the American Express Platinum Travel Credit Card, your travel adventures will be extraordinary!

Zero Lost Card Liability

If you’ve been a victim of unauthorized use of your Credit Card, you won’t be held liable for any charges as long as you’ve acted in good faith and reported the fraud to American Express within 3 working days.

That’s right, zero liability!

But, if you miss the 3-day window, don’t worry; your maximum liability will only be limited to Rs. 1000. So, rest easy knowing that American Express has your back and is always looking out for your best interests.

Supplementary Cards

As a cardholder, you get two free supplementary cards. After that, you must pay Rs 1500 + GST for each card.

Conclusion

The American Express Platinum Travel Credit Card is your key to a world of unparalleled travel benefits.

So, why not embark on your next adventure with the confidence of having the American Express Platinum Travel Credit Card in your wallet? It’s not just a card; it’s a passport to a world of unforgettable experiences. Safe travels!

Please read the other posts:

FAQs

What is the American Express Platinum Travel Credit Card, and what makes it stand out?

The American Express Platinum Travel Credit Card is a premium credit card designed for travellers. It stands out due to its extensive range of travel benefits and rewards, making it an excellent choice for those who love to explore.

How can I apply for the American Express Platinum Travel Credit Card?

To apply for the card, visit the American Express website or a local branch. You’ll need to provide personal and financial information as part of the application process.

What travel benefits does this card offer?

The card offers various travel benefits, including airport lounge access, complimentary hotel stays, travel insurance coverage, and rewards for spending on travel-related expenses.

Is there an annual fee for the American Express Platinum Travel Credit Card, and how much is it?

Yes, there is. The 1st year annual fee is Rs 3,500 + GST. 2nd year onwards, you have to pay an annual fee of Rs 5,000 + GST. But from time to time, American Express rolls out offers. Keep visiting us, and take advantage of those offers.

Can I use this card internationally, and are there any foreign transaction fees?

Yes, you can use the American Express Platinum Travel Credit Card internationally wherever American Express is accepted. There is a 3.5% foreign currency markup charge on each transaction.

How can I earn reward points with this card?

You can earn reward points by using the card for everyday purchases. It offers bonus points for travel-related expenses like flights, hotels, and dining at eligible restaurants.