American Express Platinum Reserve Credit Card Review

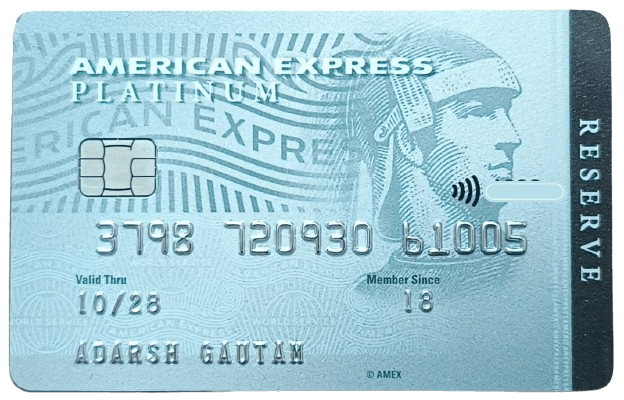

American Express Platinum Reserve Credit Card

Overview

Welcome to our comprehensive American Express Platinum Reserve Credit Card review!

You’ve landed on the right page if you’re searching for the ultimate credit card to elevate your rewards game. This review will explore all the remarkable perks and exclusive benefits of being an American Express Platinum Reserve Cardholder.

So, sit back, grab a cup of coffee, and get ready to find out if this premium financial companion is the perfect choice for you.

Rest assured, our easy-to-understand and reader-friendly article will guide you through all the essential information, making your decision-making process a breeze no matter which language you speak.

Let’s dive in!

Quick Look

American Express Platinum Reserve Credit Card

- 1st Year Fee: Rs 5,000 + GST

- 2nd Year Onwards: Rs 10,000 + GST

- Best For Travel | Dining | Shopping

- Unique Feature: If you spend 5 Lakhs a year with your card, you’ll score a sweet Taj Stay voucher worth 10,000! You can use it at any Taj, SeleQtions, or Vivanta Hotel.

Currently, an offer is going on to get an American Express Platinum Travel Credit Card with ” No 1st Year Fee“. Also, you will earn 2,000 Membership Reward Points.

Welcome Benefits

American Express Platinum Reserve Credit Card

- Complimentary 1-year membership of Taj Epicure Plus.

- Complimentary 1-year membership of EazyDiner Prime.

- Welcome Gift of 11,000 Bonus Membership Rewards Points.

Fees & Charges

| Description | Fees & Charges |

|---|---|

| 1st Year Annual Fee | Rs 5,000 + GST |

| 2nd Year Onwards Annual Fee | Rs 10,000 + GST |

| Foreign Currency Markup Charges | 3.5% of the transaction amount |

| Add-On Card Fee | * NIL for 4 cards. * Rs 1500 per card thereafter. |

| Fuel Surcharge Fee | * No fuel surcharge at HPCL fuel stations for transactions of up to Rs. 5,000. * 1% surcharge on transactions above Rs. 5,000 |

| Interest Charges | 3.5% per month. |

| Rewards Redemption Fee | NIL |

Eligibility Criteria

A few other important criteria are:

There is important information regarding availing of any American Express Credit Card.

American Express Credit Cards are currently issued to residents of Delhi/NCR, Mumbai, Bangalore, Chennai, Pune, Hyderabad, Jaipur, Kolkata, Indore, Coimbatore, Chandigarh/Tricity, Ahmedabad, Surat, Vadodara, Lucknow, Ludhiana, Nagpur, Nasik, Trivandrum and Mysuru

Milestone Benefits

Benefits of Spending Rs 5 Lakhs in a Membership Year

Get a Taj stay voucher worth Rs. 10,000 upon spending Rs. 5 Lakhs within one year of card membership while paying the annual fees of Rs. 10,000 on your card.

Monthly Voucher Programme

Simply spend Rs 25,000 or more in a calendar month, and get a unique gift code worth Rs 500. This gift code can be redeemed at various popular brands in India.

It is mandatory to “enrol” in the programme to avail of this monthly benefit.

Once you get the e-voucher, please be mindful of its usage conditions:

How will you redeem these monthly e-vouchers?

- Eligible card members should visit the link within 90 days of receiving the promo code.

- Enter the promo code (provided by American Express on your registered email ID) and your registered mobile number, then click on “Get OTP”.

- Submit the OTP and provide your choice of brand and delivery details.

- Double-check the accuracy of your delivery details before clicking on “Redeem”. The selected brand e-voucher will be sent to the email address and mobile number provided in the previous step.

Rewards Programme

As a cardholder, you’ll earn 1 Membership Rewards Point for every Rs. 50 you spend (excluding fuel, insurance, utilities, cash transactions, and EMI conversion at the point of sale).

Utilities: electricity, water and gas bills

Fuel: petrol, diesel, CNG from Oil Marketing Companies (OMCs)

Utility Services: providers of household/domestic electricity, gas and water. These providers can be government departments and agencies including local, state, and municipal organizations, public housing societies and apartment associations.

Info regarding EMI transactions

I will try to give some important info regarding EMI transactions:

You can earn Membership Rewards® Points

All EMI transactions made through American Express® SafeKey and any post-purchase EMI conversions.

You can’t earn Membership Rewards® Points

Any EMI option selected from a merchant’s website, such as online shopping with Amazon or Flipkart, and any EMI option selected at a merchant’s terminal, such as a Chip and PIN transaction at a Croma retail store, etc.

How to redeem?

You can redeem your reward points for more than 500 travel, dining, accessories, and more options. With the convenient’ Pay with Points’ feature, you can use your Membership Rewards Points to pay for your flights.

Additionally, you can use your Membership Rewards Points to cover your Card charges, providing added flexibility through Select and Pay.

Airport Lounge Access

We’ve all been there — long layovers, crowded terminals, and noisy surroundings. However, when you have the American Express Platinum Reserve Credit Card, you can wave goodbye to those discomforts.

One of its most desirable features is the complimentary airport lounge access that comes with being a cardholder, a treasure for frequent travellers.

| American Express Platinum Reserve Credit Card | No of Visits (Per Quarter) | No of Visits (Per Year) | Network |

|---|---|---|---|

| Domestic | 3 (max) | 12 | American Express |

| International | - | - | Priority Pass |

Effective September 1, 2023, access to domestic “The Centurion® American Express Lounges” in Delhi and Mumbai on your American Express Platinum Reserve Credit Card will no longer be available.

For international travel, you will get a complimentary membership of Priority Pass worth $99.

Exclusion in Priority Pass

- You must pay a usage fee of $35+GST for every international lounge visit.

- Only the “membership” is complimentary; the access fee is not complimentary.

Fuel Surcharge Waiver

Dining Delights

If you relish wining and dining at the finest establishments, then the American Express Platinum Reserve Credit Card could be your passport to a world of culinary satisfaction.

With its Fine Dining, every meal becomes an opportunity to revel in an exceptional dining experience at premier restaurants around the globe.

Enjoy exciting discounts of up to 20% on the selected restaurants.

‘Icing on Cake’ for Being a Platinum Reserve User

Taj Epicure Plus Membership

Luxury and hospitality go hand in hand with your American Express Platinum Reserve Credit Card, thanks to the complimentary Taj Epicure Plus Membership. This valuable perk unlocks a world of sophisticated experiences catering to discerning cardholders seeking nothing short of excellence in dining and hospitality at the renowned Taj Group of Hotels.

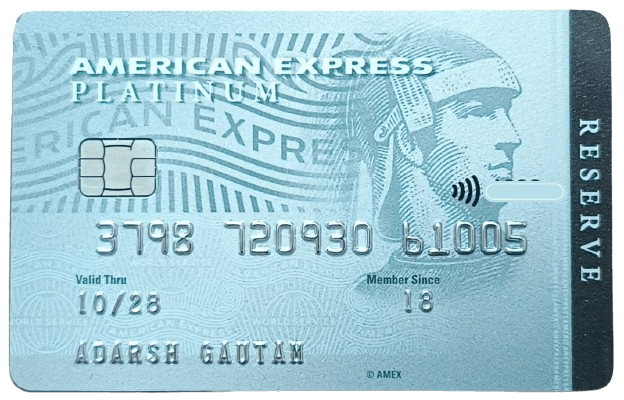

I got an email from Amex on 30th October 2023 informing me of updates in Taj Epicure Membership. Effective 1st November 2023, these updates were implemented.

As a Taj Epicure Plus member, you’ll enjoy exclusive benefits such as attractive room discounts, priority check-in, and late checkout.

The Complimentary Taj Epicure Plus Membership is available for 1 year.

And that’s not all – indulge your taste buds at participating Taj restaurants with enticing dining offers and personalized rewards earned through your annual card expenditure.

In our relatable and reader-friendly article, we’ll provide all the critical information to make the most of your Taj Epicure Plus Membership. Our human perspective ensures that understanding this coveted benefit will be a breeze no matter your language.

Prepare to enter the world of unparalleled luxury, comfort, and gastronomic delights with the American Express Platinum Reserve Credit Card. Stay with us as we continue exploring the remarkable advantages of this great card.

Contact Details ( Epicure Member Services )

- Phone: 1800 102 6080

- Email: [email protected]

- Timings: Monday – Sunday, 9:30 AM to 6:30 PM (IST)

EazyDiner Prime Membership

An exciting feast of flavours awaits you with your American Express Platinum Reserve Credit Card! One standout perk is the Complimentary EazyDiner Prime Membership that comes with being a cardholder. It’s your ticket to the fast lane for discovering and booking the finest dining spots in town.

How to Enrol?

To enrol, please call American Express helpline no. 1800-419-1030

You have to follow these guidelines if you wish to avail EazyDiner membership:

- This is a prepaid membership only valid for Basic card members.

- The offer period is valid until February 29, 2024.

- The EazyDiner Prime membership lasts for 12 months from the date of enrollment. Effective May 1st, 2023, due to a policy change, card members will need to renew their membership annually.

- Card members must enroll in EazyDiner Prime membership on or before the offer end date of February 29, 2024. If a card member has already purchased an EazyDiner Prime membership before enrolling under this benefit, their membership will automatically be extended for the following year, provided they hold an active eligible American Express card.

Unfold the joy of premium dining experiences with the American Express Platinum Reserve Credit Card. Stay tuned as we continue to dish out the juicy details of this top-tier credit card.

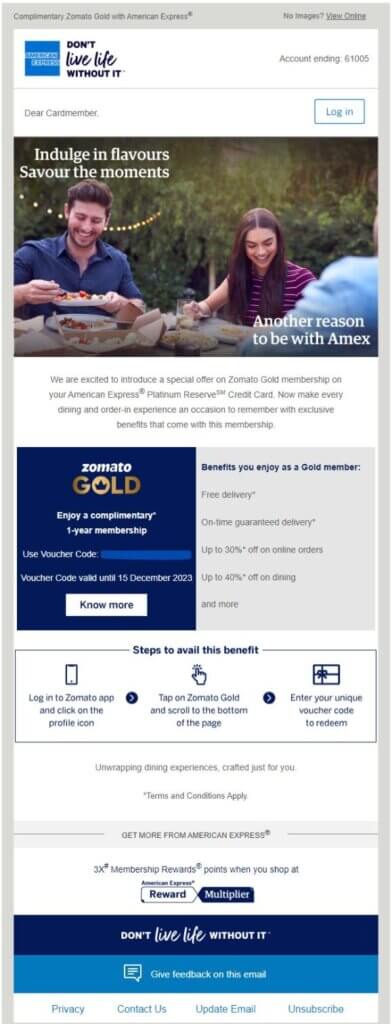

Zomato Pro Membership ( Surprise Addition )

A delicious culinary journey is within your reach with the American Express Platinum Reserve Credit Card! An exceptional benefit that cardholders will adore is the Complimentary Zomato Pro Membership. It’s the perfect companion for those who love dining out at top-notch restaurants or enjoying gourmet meals delivered to their doorstep.

Surprise Addition !!

The membership was not part of the existing benefit. Amex recently added this membership to the Platinum Reserve Card.

The Amex team informed me through emails.

Supplementary Cards

As a cardholder, you get four(4) free supplementary cards. After that, you must pay Rs 1500 + GST for each card.

Zero Lost Card Liability

Have you ever experienced that nerve-wracking moment when you can’t find your credit card? You can bid farewell to such worries with the American Express Platinum Reserve Credit Card.

One soothing feature of this card is the Zero Lost Card Liability benefit, offering you peace of mind in the face of unforeseen mishaps.

If you, as a card member have acted in good faith, your liability to American Express in the case of any unauthorized use of the Credit Card will be zero if American Express receives the report within 3 working days of the fraud. If the report is made after 3 working days, the customer’s maximum liability will be limited to Rs. 1000.

Conclusion

Our comprehensive review deeply discussed the unparalleled benefits of the American Express Platinum Reserve Credit Card. From exquisite dining experiences and top-notch hospitality to convenient delivery services and a reliable security feature, this card is an outstanding companion for your lifestyle preferences.

To recap, the American Express Platinum Reserve Credit Card enhances your day-to-day life with features like:

- Complimentary Airport Lounge Access

- Dining Benefits

- Taj Epicure Plus Membership

- EazyDiner Prime Membership

- Zomato Pro Membership

- Zero Lost Card Liability

- Customer Service ( Unmatched in India )

Embrace the world of luxury, comfort, and peace of mind with the American Express Platinum Reserve Credit Card. Treat yourself to a life of grandeur as you enjoy the unmatched perks this exceptional card brings to the table.

Don’t miss out on the opportunity to elevate your lifestyle and experiences – apply for your American Express Platinum Reserve Credit Card today!

Please read the other posts:

FAQs

What dining experiences can I expect with the American Express Platinum Reserve Credit Card?

The card welcomes you to an exquisite dining experience. You also get complimentary access to Taj Epicure Plus, EazyDiner Prime, and Zomato Pro memberships, offering discounts and exclusive benefits at top restaurants.

Does this credit card offer airport lounge access?

The American Express Platinum Reserve Credit Card offers complimentary airport lounge access. Specific terms and conditions may apply and can differ between airports.

What are the eligibility criteria for the American Express Platinum Reserve Credit Card?

Typically, American Express requires applicants to be at least 18 years old, have a good credit history, and meet income requirements. Read our blog for more details.

What benefits do I get with Taj Epicure Plus Membership?

Taj Epicure Plus Membership offers benefits like room discounts, priority check-in and late checkout, dining offers, and personalized rewards at the Taj Group of Hotels.

How does the Zero Lost Card Liability work?

With Zero Lost Card Liability, you won’t be held responsible for any fraudulent charges made on your card from the moment you report your card as lost or stolen to American Express.

Does the American Express Platinum Reserve Credit Card offer a fuel surcharge waiver?

Yes, cardholders can avail of a fuel surcharge waiver. However, the offer may be subject to specific terms and conditions, including a maximum monthly waiver cap.