Detailed Review: Jupiter Money

Jupiter Money

Overview

It seems that today’s banking institutions are adopting a more modern, tech-focused model. They may need our input from time to time. Though they are not built to serve the personalized needs of modern clients, they still offer many great resources and services like online banking.

With the arrival of the coronavirus and its effects on our bank visits, digital lending has been in strong demand. Citizens are looking for mobile banks because their bank accounts and landscapes have shifted significantly over the past decade.

Despite their longstanding reputation, some people worry about banks’ physical offices, which have traditional queues. However, banks seek to evolve and provide new features, including Jupiter Banking.

What is Jupiter Money?

Jupiter Money is a Neo bank specifically targeted Generation Z and millennials.

Jupiter isn’t itself a bank. It’s not licensed by the RBI to be a bank. Instead, it’s using the infrastructure and institutional foundation of the Federal Bank. Federal Bank seems to be the primary choice of every new Neo bank in India. Maybe because they offer competitive commission rates and their regulations are easy to match.

Are you curious enough about Neo Banks? Click here to know more !!

Who founded Jupiter Money?

Jitendra Gupta is the CEO of Jupiter Banking. He founded Citrus Pay, which he sold for $130 Mn in 2016. Another notable person involved with the Jupiter Money Project is Anupam Bagchi, who previously worked at Standard Chartered and Axis Bank. He was the vice president of the Digital Banking section at Axis Bank.

How does Jupiter Money Work?

When you deposit money into your Jupiter account; the money gets deposited in the Federal Bank and regulated.

Your Debit Card is regulated and issued by Visa, and payments to merchants through your card are settled by Visa as well. Your grievances, chargebacks, and everything else are settled by Visa as well.

As per the DICGC guidelines, the RBI ensures and keeps your money safe, insuring up to 5 Lakh INR.

Jupiter offers a debit card and an ATM card. You can use them to withdraw money, transact at local merchants, and shop online. The Visa network supports this debit card.

You can control the card, block it, set the transaction limit, freeze it when you want to, and so on.

Highlights of Jupiter Money

Jupiter Money

- Convenient on-the-go banking: Use the Jupiter app to access your bank account anytime, anywhere.

- Zero balance account: Jupiter does not require that you maintain a minimum average balance.

- Assured cashback: Earn 1% cashback on every purchase you make with Jupiter’s smart debit card or every spend made with UPI.

- Free debit card: Jupiter offers a lifetime free debit card. No charges will apply, even for replacing old or lost cards.

- No hidden charges: Jupiter has no hidden charges or bank fees. It promises a completely transparent banking experience.

- Real-time insights: Jupiter works as an expense tracker and provides real-time insights into your spending habits.

- 24×7 customer support

Fees & Charges in Jupiter Money

| Description | Fees & Charges |

|---|---|

| Zero Balance Account | Yes |

| Minimum Account Balance | NIL |

| NEFT | Free |

| RTGS | Free |

| UPI | Free |

| IMPS | First 5 transactions are FREE, from 6th transaction onwards charges are applicable - No Charges - If used under INR 1000 From INR 1000 to INR 1 Lakh - INR 5 per transaction From INR 1 Lakh to INR 2 Lakhs - INR 15 per transaction Above INR 2 Lakhs - INR 17 per transaction |

| Joining Fee for Debit Card | No Charges |

| Annual Fee for Debit Card | No Charges |

| Renewal Fee for Debit Card | No Charges |

| Transaction fees if you use Federal bank ATM | No Charges |

| Transaction fees if you use any ATM other than Federal bank | First 5 transactions per month - FREE After 5 transactions per month - INR 21 for cash withdrawal & INR 10 for balance check or mini statement per transaction |

| Account Closure | Closure can be initiated from the branch Within 6 months – INR 100 After 6 months before 12 months – INR 300 After 12 months – No Charges Note: No charges if the account is closed within 14 days from the first deposit into the account |

| Cross Currency Forex Charges | Zero forex fee on international spends Upto INR 25,000 per month (for Savings Account) Upto INR 1,00,000 per month (for Pro Salary Account) 3.5% forex fee on international spends beyond the specified limits |

Benefits of Jupiter Money

Jupiter Banking does have a few benefits, which can be discussed below:

Rewards System

Jewels don’t have any expiration limit.

You can track earnings in real time. Additionally, you can redeem jewels( when you spend, you get jewels) as cash straight into your account.

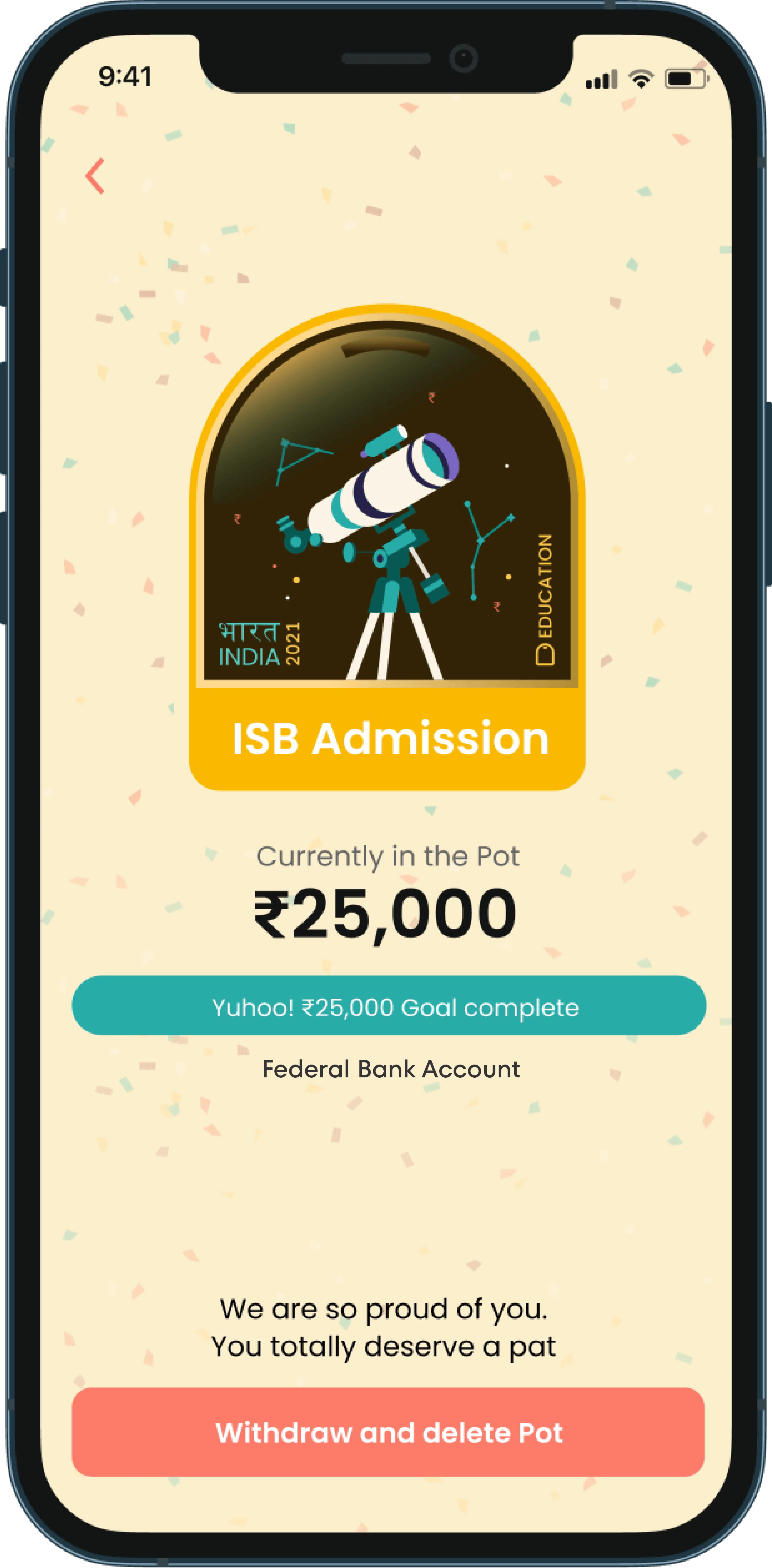

Pots Feature

Jupiter Banking terms this feature an intelligent piggy bank. It is a place where you can auto-save multiple goals and track their progress. You don’t have to pay any fee for the money movement. Also, you can do it at any time—no time constraint at all!!

Insights Feature

This is another feature that will engage you with Jupiter Banking.

It will present you with a dashboard that allows you to monitor all sorts of money movements, helping you keep track of your finances.

Whatever you have spent on the purchases can be easily viewed & monitored with smart categorization. Insights offers you the power to check your spending through notifications.

Conclusion

If you’re looking for a new bank account with cashback on every purchase and checking, consider Jupiter. With Interac Direct Payment, you get unlimited access to your funds, and the organization also specializes in financial advice for millennials.

However, Jupiter is the next big thing in banking, but it is still in early access. You can join the waitlist and get extra cashback for the first three months.

FAQ’s

What is a Neo Bank?

A Neo bank is a digital bank without a physical presence. It doesn’t have branches, paperwork, or physical verification, and it doesn’t support cash transactions.

What are the top Neo banks in India?

Some of the top Neobanks in India are: Jupiter, Fi Money, Niyo, OcareNeo, ZikZuk, Kotak 811, InstantPay, RazorpayX, North Loop and Digibank

Who is the founder of Jupiter Money?

Jitendra Gupta is the CEO of Jupiter Banking. He was the founder of Citrus Pay, which he sold for $130 Mn in 2016.

Does Jupiter Savings Account come with Zero Balance?

Yes !! There is no requirement for any kind of minimum balance. And most importantly, there are no hidden charges.

What is the Joining Fee & Annual Fee of Jupiter Debit Card?

Joining Fee – NIL & Annual Fee – NIL

Mera Jupiter Bank open Nahin ho raha hai bank ke taraf se fridge ho gaya hai kya samasya hai Bank

Mahtab, aap ko Jupiter se baat karni hogi. Aap unko call kar sakte hain – +91 08655055086 ( kisi bhi din, subeh 9 baje se raat 9 baje tak )