Axis Bank Magnus Credit Card Review

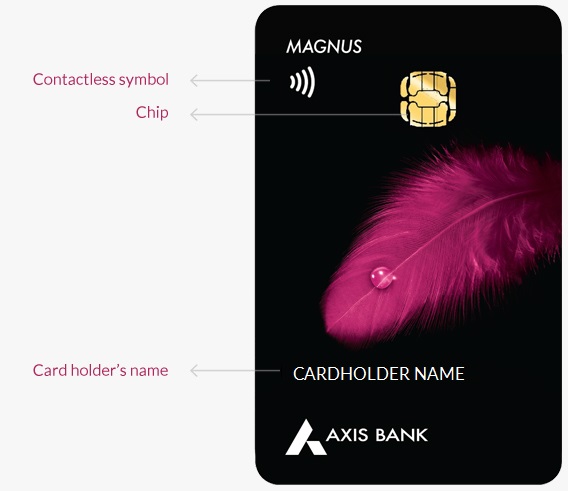

Axis Bank Magnus Credit Card

- Introduction

- Highlights of Axis Bank Magnus Credit Card

- Eligibility Criteria of Axis Bank Magnus Credit Card

- What are the documents required for the Axis Bank Magnus Credit Card?

- Fees & Charges of Axis Bank Magnus Credit Card

- How to Use the Axis Bank Magnus Credit Card?

- What are the Benefits of the Axis Bank Magnus Credit Card?

- Drawbacks of Axis Bank Magnus Credit Card

- Conclusion

- FAQ’s

Introduction

Axis Bank Magnus Credit Card comes under the Super Premium credit card category.

If you are an affluent customer, you definitely want to have this card in your wallet !!

This article will discuss the Axis Bank Magnus Credit Card, one of India’s most popular credit cards. So if you’re thinking of applying for this card, be sure to read this review first! We’ll cover everything from the card’s features and benefits to fees and charges.

Highlights of Axis Bank Magnus Credit Card

Axis Bank Magnus Credit Card

- Welcome/Annual Benefit: Choose between one complimentary domestic flight ticket and a Tata CLiQ voucher worth Rs.10000 as your annual benefit.

- Airport Concierge Services: Enjoy 8 complimentary end-to-end VIP services at the airport.

- International Lounge Access: Avail up to 8 complimentary international lounge visits per year with the Priority Pass card.

- Dineout Passport: Enjoy a 25% discount at 2000+ fine dining restaurants across India.

- Dining Delights: Enjoy up to a 20% discount at over 4000 restaurants across India.

Eligibility Criteria of Axis Bank Magnus Credit Card

What are the documents required for the Axis Bank Magnus Credit Card?

If you’re looking to apply for the Axis Bank Magnus Credit Card, you’ll need to have the following documents ready:

Once you have all the required documents, you can proceed with the online application process.

Fees & Charges of Axis Bank Magnus Credit Card

The Axis Bank Magnus Credit Card comes with many great features and benefits. However, there are also some fees and charges that you should be aware of. Here is a breakdown of the fees and charges associated with this credit Card.

| Description | Fees & Charges |

|---|---|

| Joining Fee | INR 10,000 + GST |

| Renewal Fee | INR 10,000 + GST ( Waived off after spends of INR 15 Lakhs in a year) |

| Foreign Currency Mark Up Charge | 2% of the amount |

| Finance Charge | 2.5% per month | 34.49% per annum |

| Cash Advance Fee | 2.50% of the amount | Minimum INR 300 |

| Overlimit Charge | 2.50% of the over-limit amount/Minimum INR 500 |

| Late Payment Fee | INR 300 for an amount up to INR 2,000 INR 400 for an amount between INR 2,001 INR 600 for the amount over INR 5,000 |

| Fuel Transaction Surcharge | 1% Waived on a transaction between INR 400 & INR 4,000 |

How to Use the Axis Bank Magnus Credit Card?

If an individual is looking for a premium credit card with great rewards and an annual fee waiver, the Axis Bank Magnus Credit Card is a great option. Here’s a quick guide on how to use it:

What are the Benefits of the Axis Bank Magnus Credit Card?

This card comes with several benefits that make it an excellent choice for those looking for a new credit card. Some of the benefits of the Axis Bank Magnus Credit Card include:

Travel & Stay Benefit

Travel & Stay Benefit

- Get one economy-class flight ticket across domestic locations every year.

- Enjoy up to 8 complimentary access to the international airport lounge in a year with the Priority Pass Card.

- Get unlimited access to Domestic Airport lounges across India.

- Enjoy 8 VIP Assistance at 29 Airports across India.

- The VIP Assistance will include check-in, immigration processes, security check, and porter services.

- Get a flat discount of 15% on Oberoi Hotels in India.

Lifestyle & Entertainment Benefits

Health & Wellness Benefits

Rewards Benefits

24*7 Dedicated Concierge

The card offers assistance with flight bookings, table reservations, gift deliveries, and more.

Drawbacks of Axis Bank Magnus Credit Card

Axis Bank Magnus Credit Card

- The reward point system is average for such a super premium credit card.

- The annual spend of Rs. 15 Lakhs for the reversal of the Annual/Renewal fee should have been lower.

Conclusion

The Axis Bank Magnus Credit Card is an excellent option for people seeking a credit card with amazing rewards and benefits. There is also an annual fee waiver, making this card very affordable.

In addition, the card offers a superior level of airport lounge access in domestic and international airports. There are multiple health & wellness benefits as well. In a nutshell, grab this card and enjoy the luxury !!

Please read the other posts:

FAQ’s

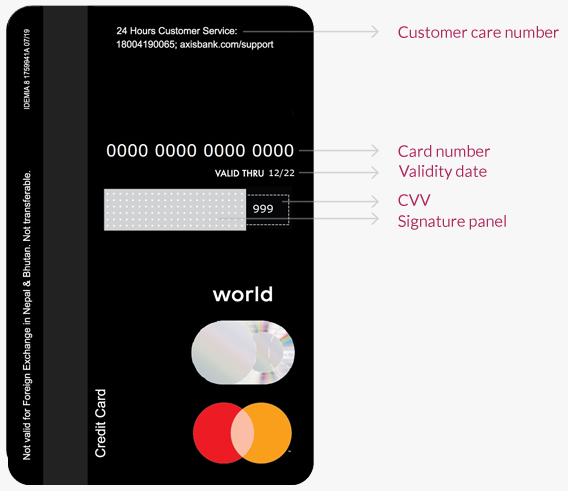

Which card network supports Axis Bank Magnus Credit Card?

MasterCard

What is the Joining Fee/Renewal Fee of Axis Bank Magnus Credit Card?

Joining Fee: Rs 10,000/- + Additional Taxes

Renewal Fee: Rs 10,000/- + Additional Taxes

What facility is offered for Domestic Airport Lounge Access?

Unlimited access to any domestic airport within India.

What offer is provided by Axis Bank Magnus Credit Card in Dining?

I) Enjoy the Discount of 25% on the Dineout application over 300+ five-star restaurants in India.

II) Get up to 20% discount on Dining Delights from axis bank over 4000 restaurants in India.

Is there a facility for reversal of Renewal/Annual Fee on Axis Bank Magnus Credit Card?

If the Minimum Annual spending is Rs 15 Lakhs, the renewal/annual fee will be nullified.