EazyDiner IndusInd Bank Credit Card Review

EazyDiner IndusInd Bank Credit Card

Introduction

Are you a food enthusiast who loves dining out? Look no further, as EazyDiner, in collaboration with IndusInd Bank, has recently unveiled an exceptional dining credit card on the Visa platform, catering to individuals who celebrate exploring restaurants.

The EazyDiner IndusInd Credit Card brings you many benefits, with significant discounts on your dining bills. This exclusive advantage is made possible through EazyDiner Prime membership. It is applicable when utilising the co-brand card for payments on the PayEazy platform within the EazyDiner app.

Discover the finest dining credit card, not just within India but globally. Let’s explore the details and why this card is a game-changer!

At A Glance

EazyDiner IndusInd Bank Credit Card

- Joining Fee: Rs 1999 + GST

- Annual Fee: Rs 1999 + GST

- Best For EazyDiner discounts & Book My Show

- Unique Feature: Redeem rewards points on the EazyDiner app

Fees & Charges

| Description | Fees & Charges |

|---|---|

| Joining Fee | Rs 1999 + GST |

| Renewal/Annual Fee | Rs 1999 + GST |

| Add-on Card Fee | NIL |

| Foreign Currency Markup Charges | 3.5% of the transaction amount |

| Interest Rates | 3.83% pr month |

| Fuel Surcharge | 1% fuel surcharge waiver on transactions between Rs. 400 and Rs. 4,000 at fuel stations. |

| Cash Advance Charges | 2.5% of the withdrawn amount subject to a minimum of Rs. 300. |

Welcome Benefits

- Complimentary EazyDiner Prime membership for one year: Get access to exclusive discounts and offers at restaurants across India, including guaranteed discounts of 25% to 50% at over 2,000 restaurants.

- 2,000 EazyPoints: Redeem for discounts and offers on various expenses, including dining, travel, and shopping.

- Postcard Hotel stay voucher worth Rs 5,000

There are a few important points to consider when using a Postcard Hotel voucher.

PostCard Hotel Voucher: Important Details

Reward Points

You can earn two types of reward points on EazyDiner IndusInd Bank Credit Card:

For a better understanding, let’s look at the below table:

| Reward Type | Spend Type | Reward Points Earned | Reward Rate |

|---|---|---|---|

| Accelerated Spends | Dining, Shopping & Entertainment | 10 RP on every RS 100 spent | 2% |

| Regular Spends | Every other Retail Spends except Fuel | 4 RP on every RS 100 spent | 0.8% |

PayEazy- EazyDiner Advantage

There is another big advantage of the EazyDiner IndusInd Bank Credit Card – you can avail premium alcoholic beverages at over 200 select restaurants. This offer can be used by each person in the group.

Here is a scenario on how you can maximise benefits on the EazyDiner app using EazyPoints and regular reward points available on the card:

| Offer Details | Amount ( Rs) |

|---|---|

| Total Billing Amount | 5000 |

| 25% Discount on your prime membership | - 1250 |

| Extra 25% Discount when paying through EazyDiner IndusInd Bank Credit Card | - 937 |

| Redeem Reward Points instantly (assume that you have 1000 reward points and value of each reward points is INR 0.20) | - 200 |

| Final Amount Payable | 2613 |

| Total Discount | 2387 |

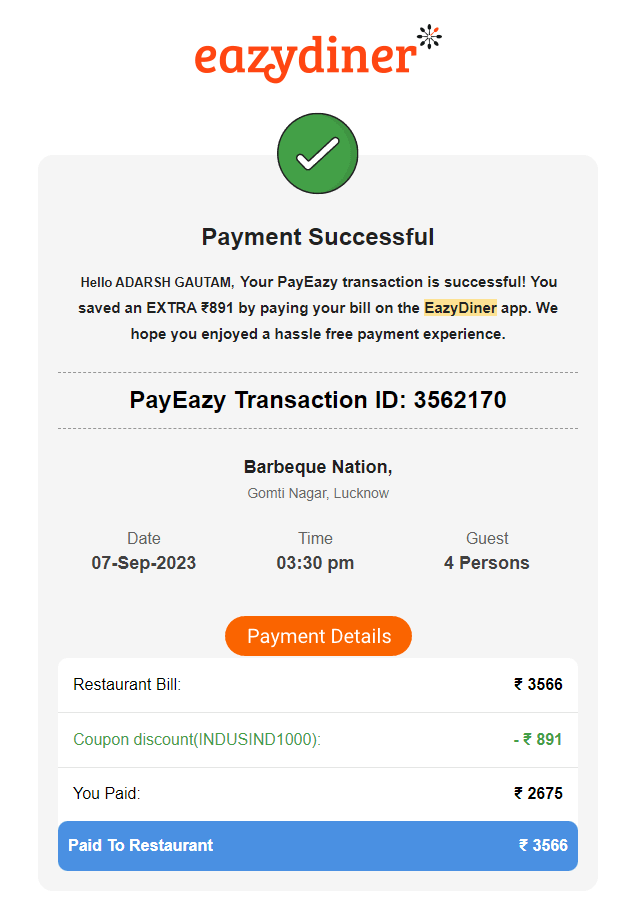

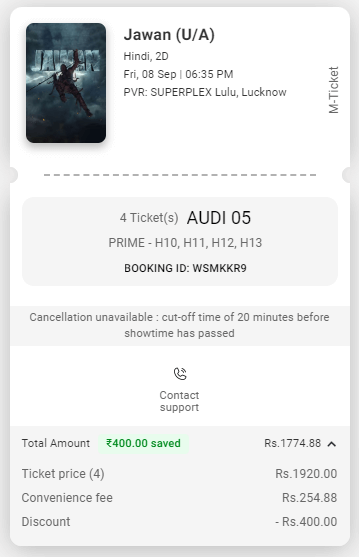

Recently, I went to a restaurant that did not offer a 25% prime discount but got a 25% discount when I paid through EazyPay. Here is the sample bill:

Seamless Transaction Facility

You can make purchases at merchant establishments, travel websites, online shopping platforms, and e-commerce websites. Additionally, you can also withdraw cash in India as well as globally.

Shop at over 1 million merchant outlets in India and more than 30 million outlets worldwide that accept card payments.

The IndusInd Bank EazyDiner credit card supports smooth transactions, be it – online, offline or contactless. You can find the merchant list here, which accepts EazyDiner Credit Card.

BookMyShow Offer

2 complimentary movie tickets worth Rs. 200 each are provided every month on bookmyshow.com

The excellent part of this offer is that it’s not a “Buy1 Get1 Offer”. That means you can also avail of Rs 400 in a single transaction.

I did the same and utilised the maximum amount of Rs 400 in a single shot using this credit card.

Airport Lounge Access

2 complimentary domestic airport lounge visits every calendar quarter in India

The IndusInd Bank EazyDiner credit card gets the lounge access facility like any other credit card with a “Visa Signature” variant. No surprises there. Nonetheless, it’s good to have one.

FYI: There is no complimentary lounge access for international travel.

Who is the ideal customer of this card?

Is it for you?

- If you dine out frequently, atleast twice in a month – then, definitely yes !!

- If you stay at luxury hotels – then, definitely yes !!

Conclusion

The EazyDiner IndusInd Bank Credit Card presents an enticing proposition for dining enthusiasts and travellers alike. Its generous rewards program, exclusive dining privileges, and travel perks open the door to a world of culinary delights and savings.

This exceptional credit card will allow you to elevate your dining and travel adventures. Start savouring the rewards it has to offer!

Please read the other posts:

FAQs

What is the EazyDiner IndusInd Bank Credit Card?

The EazyDiner IndusInd Bank Credit Card is a co-branded credit card that offers cardholders exclusive dining rewards and privileges.

Are there any joining and annual fees associated with this credit card?

Yes, there is a Joining Fee: Rs 1999+GST and an Annual Fee: Rs 1999+GST

Can I use this credit card internationally?

Yes, you can use this credit card internationally. It is accepted at over 1 million merchant outlets in India and more than 30 million outlets worldwide. It’s essential to inform the bank about your travel plans to ensure uninterrupted usage.