Yes Bank Uni Credit Card Review

Yes Bank Uni Credit Card

Overview

Hey there! If you’re thinking about getting a new credit card, you might want to check out the Yes Bank Uni Credit Card.

In this review, I’ll give you a clear idea about what this card offers, who it’s best for, and whether it could be a good fit for your wallet.

We all know that choosing the right credit card can be a bit confusing, right? By the end of this article, you’ll have a good understanding of whether this card is right for you.

Highlights of Yes Bank uni credit card

Highlights

- Unlimited 1% Cashback.

- Zero Joining Fee.

- 0% Foreign Currency Conversion Charges.

- 1% Fuel Surcharge Waiver

Fees & Charges

| Description | Fees & Charges |

|---|---|

| Joining Fee | Rs. 499 (Waived off on spending Rs. 5,000 in the first 30 days) |

| Annual Fee | Rs. 499 (Waived off on spending Rs. 50,000 in a year) |

| Finance Charges | 3.8% p.m. (45.60% p.a.) |

| Add-on Card Fee | NIL ( Maximum of 3 cards can be issued ) |

| Late Payment Fee | Up to Rs. 100: Nil |

| Rs. 101 to Rs. 500: Rs. 150 | |

| Rs. 501 to Rs. 5,000: Rs. 500 | |

| Rs. 5,001 to Rs. 25,000: Rs. 750 | |

| Rs. 25,001 to Rs. 50,000: Rs. 1,100 | |

| Above Rs. 50,000: Rs. 1,200 | |

| Rental Transactions | 1% of the transaction amount or Rs 199 (whichever is higher) applies to rental transactions over Rs 1. ( Limited to 3 within a 30-day period.) |

| Wallet Transactions | Wallet transactions over Rs 1 incur a fee of 1% or Rs 1, whichever is higher. |

| Fuel Transaction Charges | Transactions above Rs 10,000 attract a 1% fee + GST ( Monthly fuel transaction charges are capped at Rs 5,000 per customer ) |

Joining Fee and Renewal Fee( mentioned above) – Not applicable for Lifetime-Free Cards

Eligibility Criteria

1% Assured Cashback

You can enjoy 1% guaranteed cashback on your purchases! The more you shop, the more rewards you earn.

Please note

Cashback doesn’t apply to fuel, utility bills, rent payments, wallet transfers, ATM withdrawals, or international transactions. Keep earning while you spend smartly!

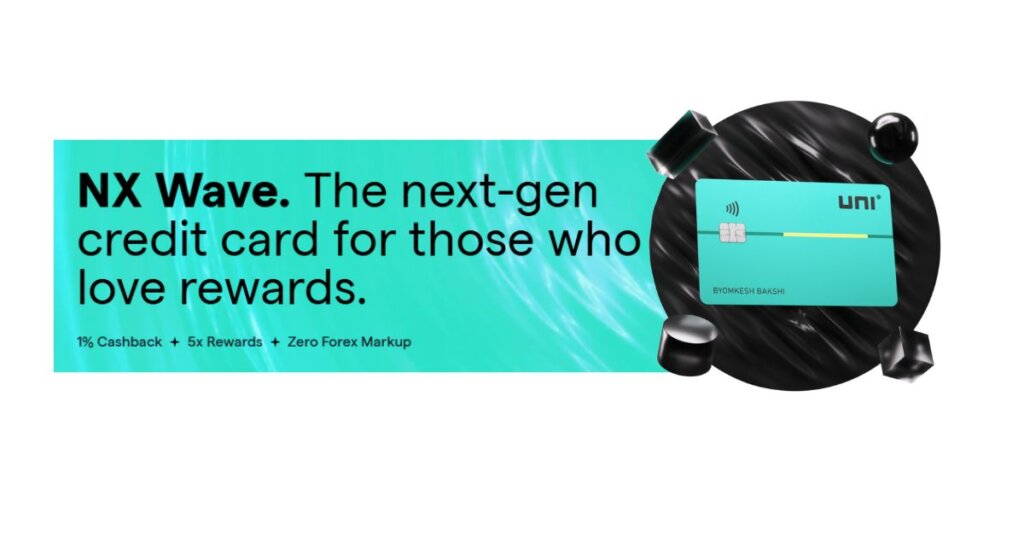

5X More Value

Unlock 5x the value of your cashback exclusively at the Uni Store! Get more for your money and enjoy unbeatable rewards

Zero Forex Markup

Travel the world worry-free with Zero Forex Markup! Shop, dine, and explore internationally without paying extra fees.

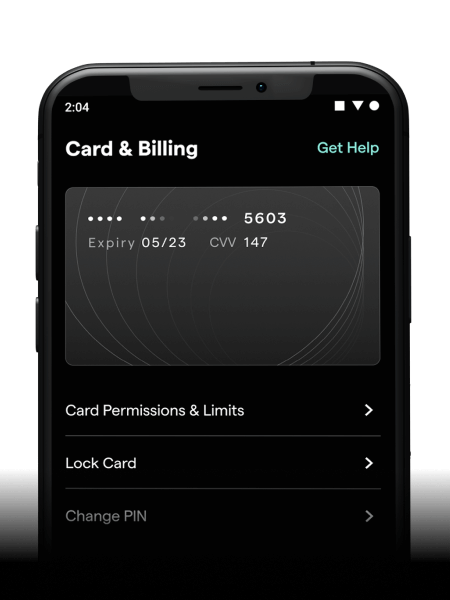

Your Card, Your Rules

Take control of your spending like never before! Set your own limits, decide where to spend, and lock or unlock your card anytime—all with just a tap on the app.

Support That’s Always On

Need help? They’re just a WhatsApp message away—anytime, any day. Whether it’s during your busiest work hours, a relaxed Sunday morning, or in the stillness of night, they’re there for you around the clock!

Conclusion

So, that’s a wrap on my Yes Bank Uni Credit Card review! If you’re looking for a card that offers good rewards, attractive interest rates, and convenient features, the Yes Bank Uni Credit Card might be just what you need. It’s especially great if you love earning rewards on your everyday spending.

Remember, choosing the right credit card is a personal decision. Make sure to think about your own needs and spending habits before making a choice. If the Yes Bank Uni Credit Card fits your lifestyle, then it could be a great addition to your wallet.

FAQs

How can I check my Yes Bank Uni Credit Card balance?

You can check your credit card balance through Yes Bank’s online banking portal, mobile app, or by contacting customer service.

What should I do if I lose my Yes Bank Uni Credit Card?

If you lose your Yes Bank Uni Credit Card, you should immediately contact Yes Bank customer service to report the loss and block the card to prevent unauthorized use.

Can I use the Yes Bank Uni Credit Card for international transactions?

Yes, the Yes Bank Uni Credit Card can be used for international transactions, but it’s a good idea to check the foreign transaction fees and notify the bank before travelling abroad.