ICICI Coral Credit Card Review

ICICI Coral Credit Card

Introduction

ICICI Coral Credit Card is the most basic credit card under the “Gemstone” collection from ICICI Bank for Indian customers. This card comes in three variants – MasterCard, American Express, and Visa.

Disclaimer: The Reserve Bank of India (RBI) has, vide order dated April 23, 2021, imposed restrictions on American Express Banking Corp. from onboarding new domestic customers onto their card networks, with effect from May 01, 2021. Accordingly, ICICI Bank Limited shall be unable to accept further applications for ICICI Bank Credit Cards on the American Express Network. However, please note that this order does not impact existing customers.

Disclaimer: The Reserve Bank of India (RBI) has, vide order dated July 14, 2021, imposed restrictions on MasterCard Asia/Pacific Pte. Ltd. from on-boarding new domestic customers onto their card networks, with effect from July 22, 2021. Accordingly, ICICI Bank Limited shall be unable to accept further applications for any ICICI Bank Credit Cards on MasterCard network. However, please note that this order does not impact existing customers.

In short, new credit card applications for Coral Credit Card on Amex & MasterCard networks have been restricted by RBI. But, we did not come across any such restrictions for the Visa network.

This card comes with low annual maintenance and provides a host of travel, food, and entertainment benefits. It has stiff competition with its contemporary low-maintenance cards like SBI SimplyCLICK Credit Card and the HDFC MoneyBack Credit Card.

Highlights of ICICI Coral Credit Card

ICICI Coral Credit Card

- Annual Fee: Rs. 500

- Earn up to 2 PAYBACK Points on every Rs. 100 spent on the card

- Avail bonus PAYBACK Points on reaching spending milestones

- 1 complimentary Airport Lounge visit and Railway Lounge visit in a quarter

- 2 complimentary movie tickets every month from BookMyShow

- Enjoy the ‘Buy One Get One’ offer at INOX Cinemas

- Enjoy 1% fuel surcharge waiver at HPCL petrol pumps across India

- Save at least 15% on your dining bills at select restaurants across India

Fees & Charges

| Description | Fees & Charges |

|---|---|

| Issuing Fee( One time) | INR 1,000 + GST |

| Annual Fee( for 1st year) | NIL |

| Annual Fee( per annum - from 2nd year onwards) | INR 500 + GST |

| Add on Card Charges | NIL |

| Annual Fee Waiver | On the spend of INR 1.5 Lakhs or more |

| Overdue Interest on Extended Credit | Monthly Rate - 3.40% Annual Rate - 40.80% |

| Foreign Currency Mark-up Fee | 3.50% |

| Card Replacement Fee | INR 100 |

| Late Payment Charges | NIL - amount less than INR 100 INR 100 - amount between INR 100 and INR 500 INR 500 - amount between INR 501 and INR 10,000 INR 750 - amount more than INR 10,000 |

Eligibility Criteria

Card Features

ICICI Coral Credit Card does come with a few excellent features for its customers. We will discuss them now:

Welcome Benefits

This card does not have any welcome benefit in the current times. The provision of this feature can be provided to customers at any time. The info will be updated here in such a case.

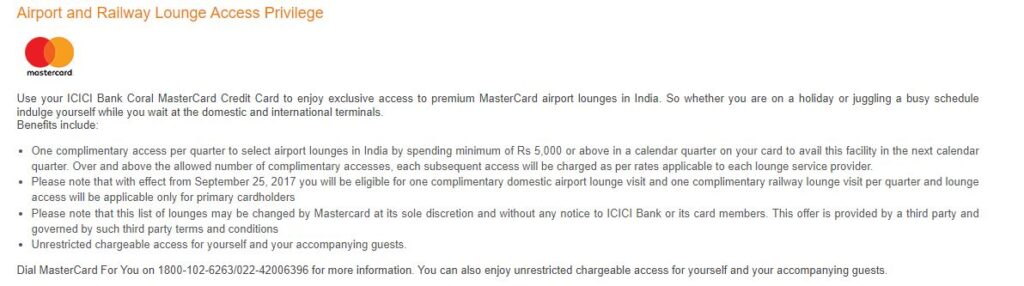

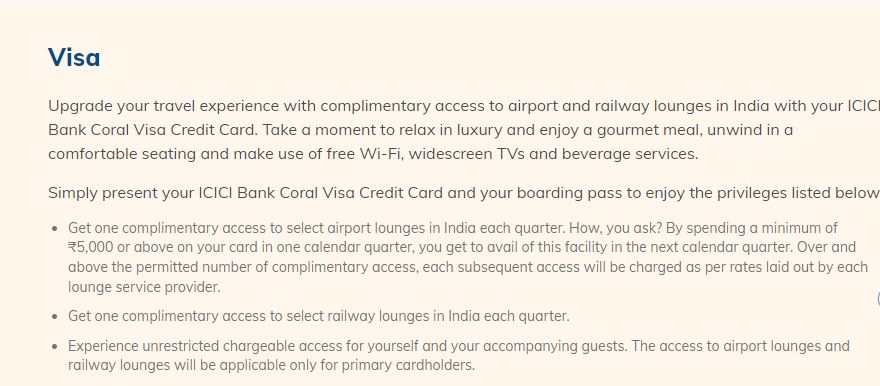

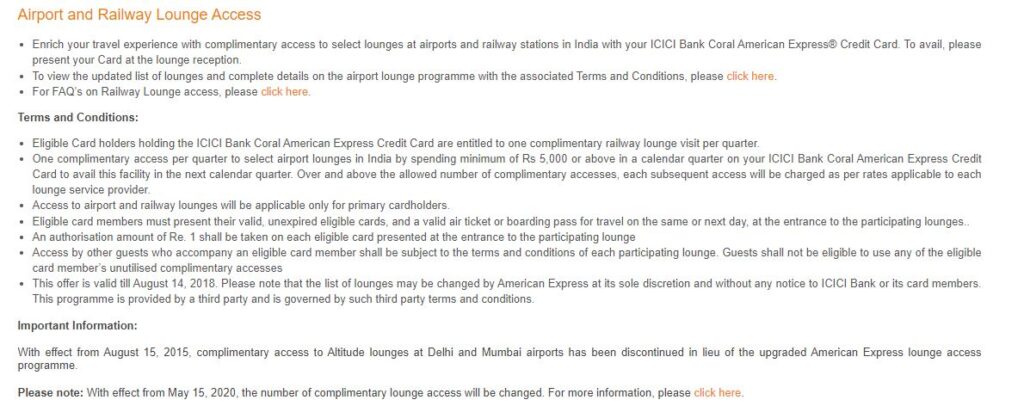

Airport lounge Access

A minimum spending of Rs. 5000 in the previous quarter makes you eligible for 1 complimentary access to a few selected airport lounges in any given quarter across India.

In short, the eligibility for the complimentary airport lounge is to spend Rs. 5000 and above in the last 3 months.

Please visit these respective links to check the list of Airport & Railway Lounges in India:

Railway Lounge Access

Finally, a mainstream credit card like Coral Card from ICICI offers railway lounge benefits. For any train-travel enthusiast, this feature on a credit card will definitely put a smile on the face.

The card offers 1 complimentary access to select domestic railway lounges per quarter.

Therefore, you have access to choose railway lounges 4 times a year.

The railway lounges can be accessed through the buttons given above under Airport lounge access.

Fuel Surcharge

1% waiver on fuel surcharge on a minimum spend of Rs. 4000 per transaction at all HPCL fuel stations across India.

Offers on Dining, Wellness and Hotels

You can experience the finest dining experiences with equally impressive savings from this card. ICICI promotes exclusive dining offers through ICICI Bank Culinary Treats Programme.

You can view all kinds of offers here:

PAYBACK points

Your ICICI Bank Credit Card enables you to earn PAYBACK Points on the transactions. PAYBACK, India’s most extensive Reward Programme, has powered ICICI Bank Rewards to bring you exciting rewards for your everyday spending.

You not only earn PAYBACK Points when you use your ICICI Bank Credit Card, but also earn additional points from PAYBACK Partner Brands for the same purchase.

You can redeem the PAYBACK Points from multiple options – from movie and travel vouchers to lifestyle products, mobiles, appliances, etc. Shopping is advantageous when you have the PAYBACK feature on the ICICI Bank Credit Card!

Rewards Structure

- 2 PAYBACK Points can be earned on every Rs. 100 spent, excluding fuel transactions.

- 1 PAYBACK Point can be earned on every Rs.100 spent on utilities and insurance.

- Under the umbrella of the Milestone Rewards program, 2000 PAYBACK Points can be availed on spending Rs. 2,00,000. 1000 PAYBACK Points can be availed each time you cross Rs. 1,00,000 spent after that in an anniversary year; a maximum of 10,000 PAYBACK Points per year.

The reward points you earn get accumulated with PAYBACK every month and can be redeemed for cash or gifts of your choice.

Conclusion

The ICICI Coral Credit Card is an excellent option for those looking for a credit card with plenty of features and benefits. This credit card hosts multiple offers, from the generous rewards program to the low-interest rate. If you search for a new credit card, check out the ICICI Coral Credit Card.

Please read these posts too:

FAQ’s

What collection does ICICI Coral Credit Card belong to?

Gemstone Collection

How many variants are there for ICICI Coral Credit Card?

Total 3 Variants – MasterCard, Visa & American Express

What is the highlight feature of the ICICI Coral Credit Card?

1 complimentary Airport Lounge visit and Railway Lounge visit in a quarter

What is the Annual Fee of ICICI Coral Credit Card?

Rs 500 + GST

Does ICICI Coral Credit Card offer any feature for Restaurants?

Save at least 15% on your dining bills at select restaurants across India