Informative Review: IndusInd Bank Visa Signature Debit Card

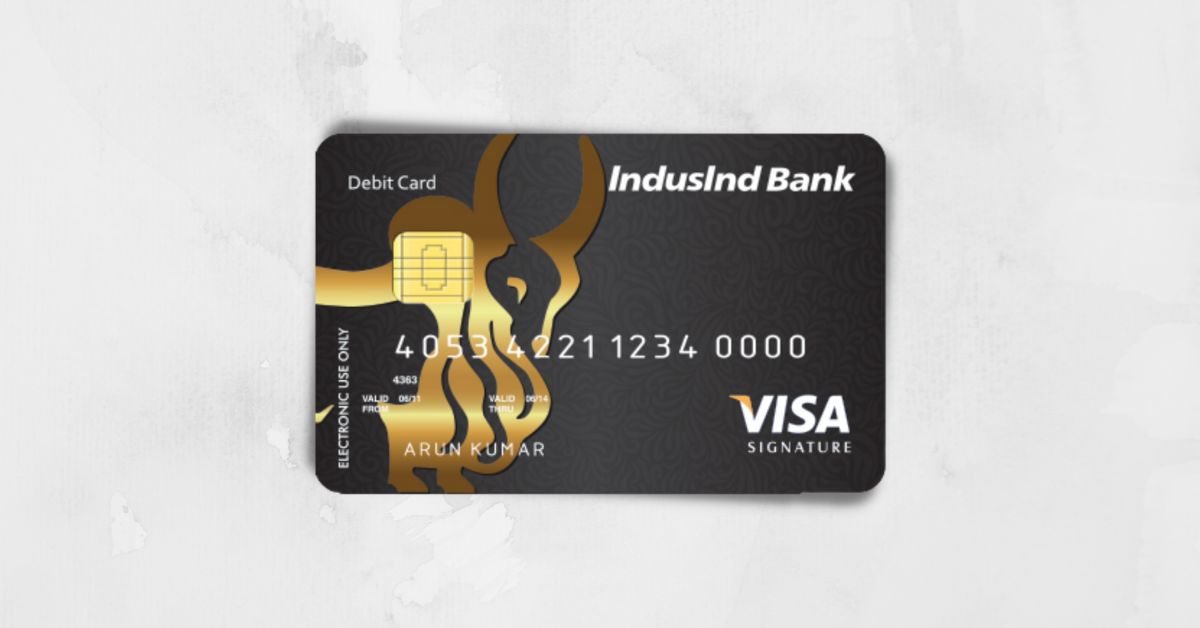

IndusInd Bank Visa Signature Debit Card

IndusInd Bank’s Visa Signature Debit Card is one of the best debit cards in India. It comes with many features and benefits, making it an excellent choice for customers looking for a better debit card.

This includes cashback, discounts, and rewards. It also comes with a 0% interest rate on balance transfers and purchases for the first 3 months.

In this review, we’ll look at the IndusInd Bank Visa Signature Debit Card and see if it’s right for you.

Introduction

The IndusInd Bank Signature Debit Card is an excellent option for the modern consumer. It allows you to use it to make purchases at over 4,00,000 merchant locations in India and 33 million worldwide.

The card offers secure online shopping and will enable you to recharge your mobile phone. Moreover, you can get a bonus of 100 points upon activation at an ATM and mobile banking.

Besides being convenient and secure, the IndusInd Bank Signature Debit Card allows you to withdraw cash from over a million ATMs worldwide.

The card can be used for travel, dining, wellness, apparel, and holiday expenses. In addition to the rewards, you will also get ATM withdrawals at more than a million locations worldwide through bilateral agreements with network partners. There is also no minimum balance requirement.

Eligibility Criteria

The IndusInd Bank Visa Signature Debit Card is an excellent option for individuals looking for a debit card with plenty of perks and rewards. You will need to meet some eligibility criteria to apply for this card. Here are the main eligibility criteria:

Fees & Charges

The Axis Bank Burgundy Debit Card comes with a number of fees and charges that cardholders should be aware of.

| Description | Fees & Charges |

|---|---|

| Joining Fee | Rs 5,000 + Taxes |

| Annual Fee | Rs 1,499 + Taxes |

| ATM Withdrawal Limit (Per Day) | Rs. 1,50,000 |

| POS Limit per day | Rs. 3,00,000 |

| Personal Accident Insurance Cover | Rs. 2,00,00 |

| Air Accident Insurance Coverage | Rs. 30,00,000 |

| Lost Card Liability Coverage | Rs. 3,00,000 |

| Purchase Protection Coverage | Rs. 50,000 |

Key Features and Benefits

The IndusInd Bank Visa Signature Debit Card is a great choice for those who are looking for a card with great features and benefits. Some of the key features of this card include:

IndusInd Bank Visa Signature Debit Card

- Rs 5,000/- worth XtraSmiles Points

- Rs 5,600 worth of Annual Movie Tickets

- Complimentary Lounge Access

- Fuel surcharge waiver of up to Rs. 250 every month

- Earn up to 6X reward points for every Rs 200 spent

Conclusion

The IndusInd Bank Visa Signature Debit Card is an excellent option for a versatile and convenient debit card. Many features and benefits make this card one of the most popular options on the market. Suppose you’re looking for a debit card that can offer you great rewards and perks. In that case, the IndusInd Bank Visa Signature Debit Card is worth considering.

Please read the other posts:

FAQ’s

What is the maximum amount of purchases a person can make with their contactless card in one day?

You can make up to 5 contactless transactions on this card for less than Rs 5000 each day. Any transactions worth more than Rs 5000 will require a cardholder to use the card and enter their PIN code.

Is this the limit on withdrawing Rs. 5000 in any country, or just in India?

Contactless payments have different limits depending on your country and which terminal you use. The maximum amount you can spend with a credit card is determined by your limit on the card. Daily transactions with a debit card are restricted to a certain amount.

Is it possible to accidentally enter a contactless transaction by walking past the terminal?

No. You have to tap your card within 4 cm of the card reader for more than half a second. The retailer has to enter the amount first before you can approve it. Terminals can only process one payment transaction at a time, which reduces errors.

How many free visits are allowed for the airport lounges in India on the IndusInd Bank Visa Signature Debit Card?

2 visits per quarter