SBI Aurum Credit Card Review

SBI Aurum Credit Card

Overview

Namaste, friends! Are you looking for a credit card that screams luxury yet promises value? Well, I’ve got the inside scoop on one that might be the golden ticket you’re searching for – the SBI Aurum Credit Card.

In India, where we love getting more value for our money, an aurum credit card like this one from SBI has sparked a lot of interest due to its numerous benefits.

I’ve decided to take a deep dive and give you a straightforward, no-frills review. Stay tuned, ’cause I’m about to spill the tea on whether the SBI Aurum Credit Card is the glittering addition to your wallet you’ve been waiting for.

Let’s find out together if it’s genuinely as good as gold!

Take A Glance

SBI Aurum Credit Card

- Joining Fee: Rs 9999 + GST

- Annual Fee: Rs 9999 + GST

- Best for: Movies | Travel | Dining | Shopping

- Reward Type: Reward Points

- Best Feature(s): Airport Lounge Access, Shopping, Reward Points

Welcome Benefits

SBI Aurum Credit Card

- 40,000 reward points worth Rs 10,000

- 1-year Club Marriott Membership offering discounts on room tariffs, restaurants, and spa services at Club Marriott hotels in India

- 1-year Digital membership to Mint and WSJ

Fees & Charges

| Description | Fees & Charges |

|---|---|

| Joining Fee | Rs 9999 + GST |

| Annual/Renewal Fee | Rs 9999 + GST |

| Spend Based Waiver | Renewal/Annual fee waived off on spending of minimum Rs 12 Lakhs |

| Add-on Card Fee | NIL |

| Reward Redemption Fee | NIL |

| Foreign Currency Markup Charges | 1.99% |

| Fuel Surcharge Waiver | 1% |

| Interest Rates | 3.5% per month ( 42% anually) |

| Minimum Repayment Amount | 5% |

| Cash Withdrawal Fee | 2.5% |

| Cash Advance Limit | 80% |

| Card Replacement Fee | Rs 1500 |

Eligibility Criteria

Currently available in these cities/regions only to: NCR, Mumbai & suburbs, Chennai, Hyderabad, Bangalore, Pune, Jaipur, Chandigarh, Kolkata, Ahmedabad, Surat, Coimbatore, Kochi, and Vishakhapatnam

Documents Required

Proof of Identity

PAN Card, Aadhaar Card, Driver’s License, Passport, Voter’s ID, Overseas Citizen of India Card, Person of Indian Origin Card, Letters issued by the UIDAI, Job Card issued by NREGA or any other government-approved photo ID proof.

Proof of Address

Aadhaar card, Driver’s License, Passport, Utility Bill not older than three months, Ration, Property Registration Document, Bank Account Statement, Person of Indian Origin Card, Job card issued by NREGA, or any other government-approved address proof.

Proof of Income

Latest one or two salary slips (not older than three months), latest Form16, and the last three months’ bank statement.

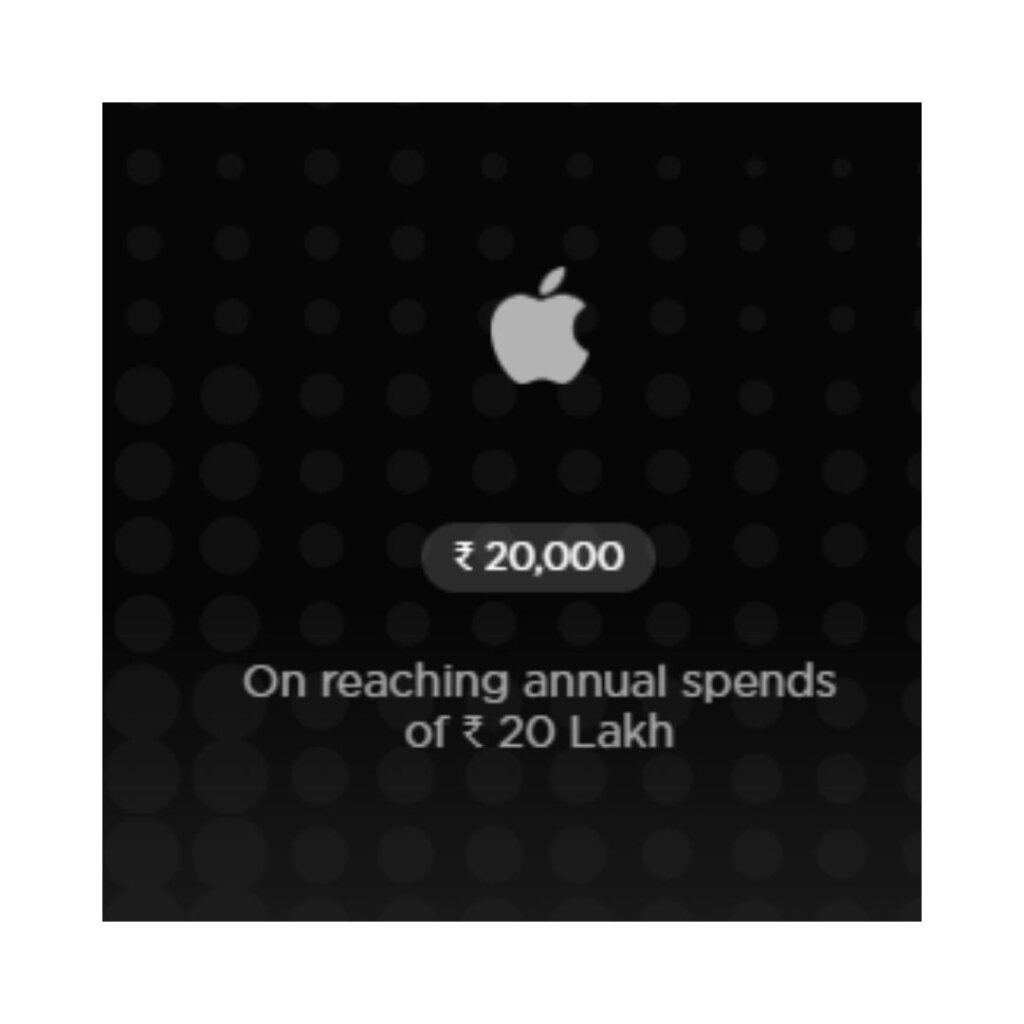

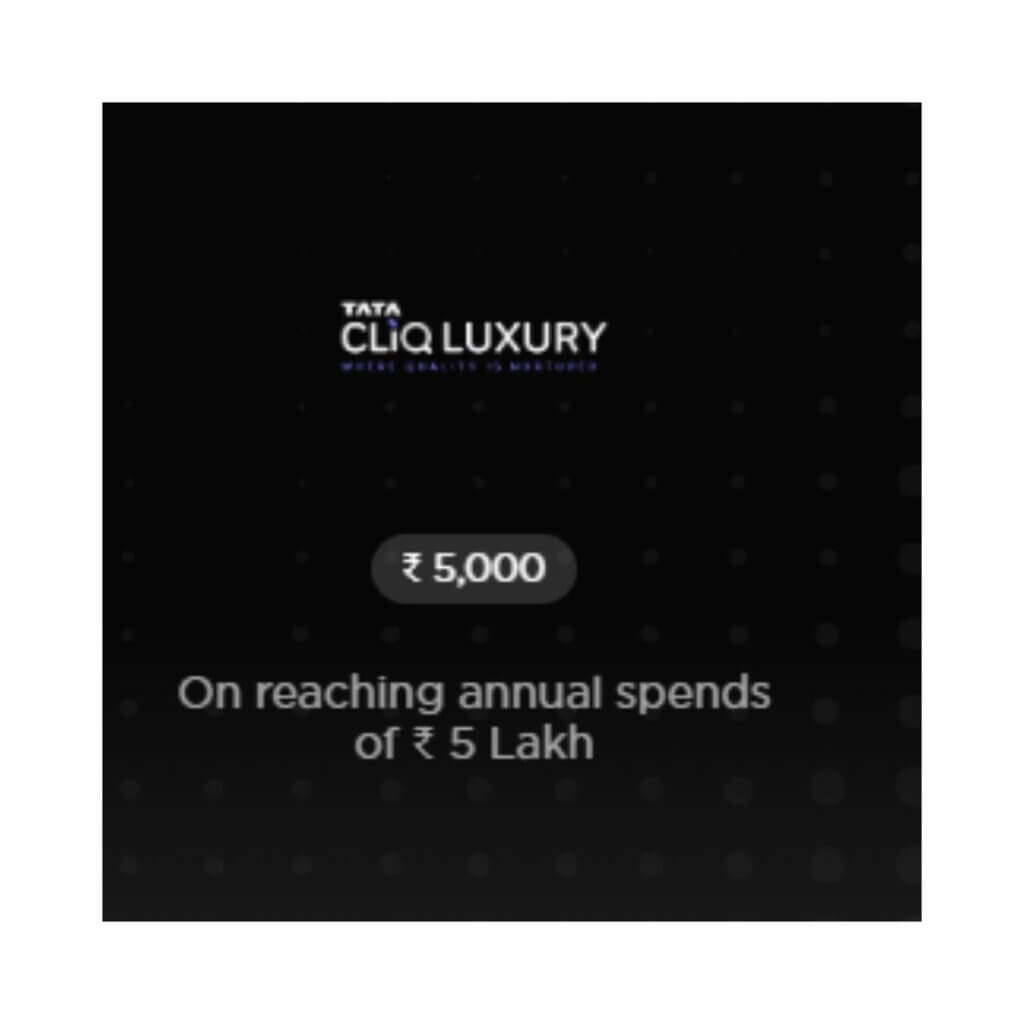

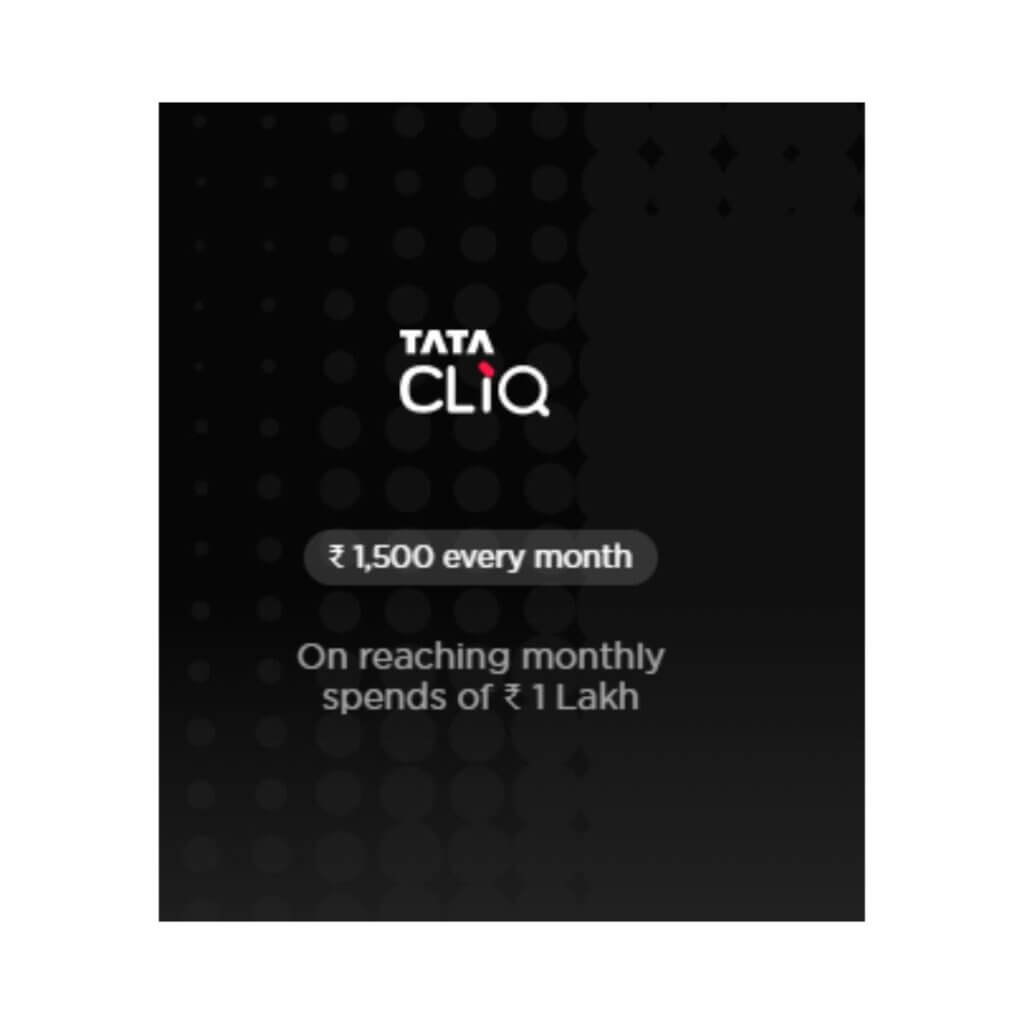

Milestone Vouchers

Reward Points

How to Earn?

The reward points for the SBI Aurum Credit card are known as Aurum Reward Points(ARP).

Earn 4 Aurum Reward Points for every Rs 100 spent on all transactions except fuel.

( 1 ARP ~ Rs 0.25 )

The highlight feature of the reward points is that they never expire.

How to Redeem?

The reward points earned can be redeemed for gift vouchers, flight bookings, and hotel reservations on the dedicated AURUM Rewards portal.

| Reward Points | Redemption Value |

|---|---|

| 4 ARP | 1 Club Vistara Points |

| 4 ARP | 1 Air Asia Point |

| 5 ARP | 1 Club ITC Green Points |

Airport Lounge Access

Domestic Access

- 4 complimentary domestic airport lounge visits per quarter.

- Add-on cardholders avail themselves of up to 2 visits per quarter.

- The AURUM Card will be charged a usage fee plus applicable taxes for lounge utilization beyond the complimentary visits.

International Access

- Get a complimentary DreamFolks Membership and enjoy unlimited access to over 1,000 international airport lounges. Additionally, bring a guest for a complimentary visit once a quarter.

| Airport Lounge Access | Network | No of Visits(per quarter) | Add-on CardHolders (per quarter) |

|---|---|---|---|

| Domestic | VISA | 4 | 2 |

| International | DreamFolks | Unlimited | 1 |

Spa Access

1 complimentary spa access at select airports every quarter within India.

BookMyShow Benefit

Golf Privileges

Aurum Secretarial Access

Cardholders can authorize a secretary or executive assistant to conduct limited interactions with SBI Card on their behalf.

Fuel Surcharge Waiver

The SBI Aurum credit card offers a fuel surcharge waiver in India, which can save you money on everyday fueling needs.

- You won’t be charged the extra 1% fee on petrol purchases between Rs 500 and Rs 4,000.

- There’s a maximum waiver of Rs 250 per statement cycle.

Are you in trouble?

Conclusion

So, we’ve reached the end of our journey exploring the SBI Aurum Credit Card. What’s the final word on it? If you’re a fan of luxury and don’t mind extra spending, this Aurum credit card could be a great match for you. It offers some pretty cool benefits, like free trips to the airport and deals on eating out.

But the real question is, does it align with your everyday life and spending habits?

If you nod ‘yes’ and these benefits make you smile, then go for it!

The SBI Aurum Credit Card could be a fantastic new addition to your pocket. Thanks for reading, and I hope this review has given you the confidence to pick the card that’s right for you!

FAQs

What kind of benefits does the Aurum credit card offer?

This card offers access to airport lounges, discounts on eating out, and points you can earn to buy things. It’s perfect for people who travel a lot or dine out often.

Who should consider getting an SBI Aurum Credit Card?

If you spend a lot on travel, dining, and luxury experiences and want rewards for your spending, this card might be a good fit.

How do I apply for an SBI Aurum Credit Card?

You can apply for this card through SBI’s official website or by visiting an SBI bank branch. Sometimes, the bank might also send you an invitation to apply.