American Express Membership Rewards® Credit Card Review

American Express Membership Rewards® Credit Card

Introduction

American Express Membership Rewards® Credit Card is one of the country’s most advantageous entry-level credit cards. As the name suggests, it is a rewards segment card whose offers are hard to deny.

It is to be noted that American Express is a payment network processor. Like we have “Visa” and “Mastercard.” American Express(AMEX) issues credit cards in India. They don’t support debit cards.

It is enabled for contactless transactions as well. Now, we will discuss this product with its advantages and disadvantages(if any) so that as a consumer, you can make the right choice !!

American Express Membership Rewards® Credit Card

- Welcome Gift of 4,000 Bonus Membership Rewards® Points

- Earn 1,000 Bonus Membership Rewards®Points for simply using your Card 4 times on transactions of Rs. 1,500 and above every month

- Redeem your Points from the fabulous 18 and 24 Karat Gold Collection

- Earn an additional 1,000 Membership Rewards points simply by spending Rs 20,000 or more in a calendar month. This is an enrollment-based benefit.

- Enjoy exciting discounts on dining, travel, car rental, and shopping.

Fees & Charges of American Express Membership Rewards® Credit Card

| Description | Fees & Charges |

|---|---|

| First Year Fee | Rs 1,000 plus applicable taxes |

| Second Year Onwards | Rs 4,500 plus applicable taxes |

| Add-on Fee | NIL |

| Renewal Fee Waiver | Renewal fee of Rs 4500 will be 100% waived off if total spends on American Express Credit Card in the immediately preceding membership year is Rs 1,50,000 and above |

| Renewal fee of Rs 4500 will be 50% waived off if total spends on American Express Credit Card in the immediately preceding membership year is between Rs 90,000 and Rs 1,49,999 |

Eligibility Criteria of American Express Membership Rewards® Credit Card

The American Express Cards are currently issued to residents of Delhi/NCR, Mumbai, Bangalore, Chennai, Pune, Hyderabad, Jaipur, Indore, Coimbatore, Chandigarh, Ahmedabad, Surat, Vadodara, Lucknow, Ludhiana, Nagpur, Nasik, Trivandrum, and Mysuru subject to condition.

Benefits of American Express Membership Rewards® Credit Card

American Express Membership Rewards® Credit Card comes with some excellent features which can attract Indian customers. So, we will move forward to list out a few features of this card:

Bonus Membership Rewards Points

- You will earn 1,000 Bonus Membership Rewards Points for simply using your Card 4 times on transactions of Rs 1,000 and above during each calendar month.

- Now, from 1st April 2021 onwards, the transaction amount has been increased to Rs 1500 and above during the calendar month to get 1,000 Bonus Membership Rewards Points.

Monthly Spend Milestone

You will earn an additional 1,000 Membership Rewards points simply by spending Rs 20,000 or above in a calendar month. This is an enrollment-based benefit.

Additional Rewards On Card Renewal

You will earn 5,000 membership rewards points upon first-year card renewal on the payment of the annual membership fee. These points will be credited within 90 days of card renewal.

Rewards Programme

Offers & Privileges

American Express Membership Rewards® Credit Card offers multiple exciting and exclusive offers and privileges and much more.

Easy and Flexible EMI Conversion

You can enjoy the convenience of paying your Credit Card bill, fully or partially. You can also convert your spending into easy monthly instalments with the American Express EMI.

Fuel Convenience Fee Waiver

- 0% Convenience fee on fuel purchase at HPCL for transactions less than Rs. 5,000.

- 1% Convenience fee on fuel purchases per transaction is applicable for all transactions of Rs. 5,000 and above.

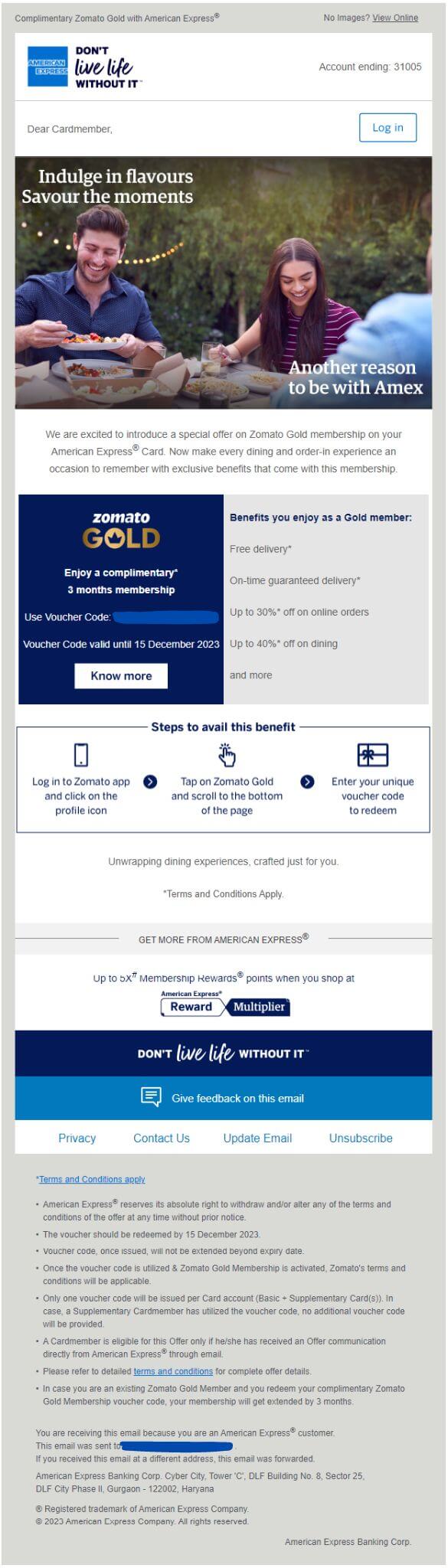

Dining Benefits

This card will make you enjoy exciting discounts of up to 20% every time you dine at select restaurants.

Other Excellent Services Offered

- 24X7 Card Related Assistance

- Dispute Resolution

- Zero lost Card liability

- Emergency Card Replacement

- Contactless Payment

Insurance Benefits

Other than offering you multiple offers across the year, Amex MRCC provides you with the facility of Health Insurance and Car Insurance as well. These insurance offerings are much better than any other competitor in the Indian market.

If you have not opted for either – Health or Car Insurance, then, this could be a very good deal for you.

Drawbacks of American Express Membership Rewards® Credit Card

Drawbacks of Amex MRCC

Despite being an entry-level credit card, it provides convenience, flexibility, and enjoyment to the likes of a premium credit card. It’s hard to pick any shortcomings in it. But, if we have to nitpick, we could say, the card design can be looked at !! And in general, American Express has to work on increasing its reach to most of the regions in India.

This credit card is a small pocket rocket. If you are interested to know more about its features and offers

Please read other posts too:

FAQ’s

Is there any Welcome Gift for American Express Membership Rewards® Credit Card?

4,000 Bonus Membership Rewards® Points

What is the highlight feature of the American Express Membership Rewards® Credit Card?

18 and 24 Karat Gold Collection

Is there Airport Lounge Access on American Express Membership Rewards® Credit Card?

No

What is the 1st Year Fee on American Express Membership Rewards® Credit Card?

INR 1,000 plus applicable taxes

Does American Express Membership Rewards® Credit Card offer any special offers?

You will earn an additional 1,000 Membership Rewards points simply by spending INR 20,000 or above in a calendar month.