Fi-Federal Debit Card Review

Fi-Federal Debit Card

Overview

In the fast-paced digital age, your debit card should do more than just make transactions. It should simplify your life, reward you, and save your money. That’s exactly what the Fi-Federal Debit Card offers. This blog dives deep into why Fi Money’s debit card stands out in a market flooded with options. Let’s break it down for you.

At A Glance

Fi-Federal Debit Card

- Joining Fee: Rs 199 + GST

- Annual Fee: Rs 199 + GST

- Reward Type: Reward Points

- Best Feature(s): Airport Lounge Access, Shopping, Reward Points

For Plus and Standard account plan users

- Annual fee: Rs 199 + GST

- Effective March 8, 2025, this fee will increase to Rs 299 + GST

Key Benefits

International Benefits

Domestic Benefits

Wave Goodbye to Forex Charges

With the Fi-Federal Debit Card, you can save significantly on your international spends, including ATM withdrawals. Unlike traditional debit, credit, or forex cards that charge a forex fee of 3-5% on international transactions, the Fi-Federal Debit Card waives off these fees on select plans. This makes it an ideal companion for travelers and online shoppers who transact in foreign currencies.

By eliminating forex fees, the Fi-Federal Debit Card helps you get more value for every rupee spent abroad, making international payments smarter and more cost-effective.

Travel Smart: One Card for 180+ Countries

This debit card simplifies international travel and spending, ensuring you’re ready for any destination without the hassle of managing foreign currency. Just add INR to your account and spend seamlessly in 180+ countries with your debit card—no need to carry foreign cash or paper currency.

Why It’s a Game-Changer

- Convenient Spending: Use your Fi-Federal Debit Card globally and stay worry-free.

- Earn While You Spend: Get up to 7.75% interest on your balance.

- No Currency Loading Fees: Add INR funds without any extra charges.

You can check this table for a more clear understanding:

| Activities | Fi-Federal Debit Card | |

|---|---|---|

| Spends using card | Forex Markup Fees | 0% |

| ATM | Withdrawal Fee | Rs 200+GST |

| Forex Markup Fees | 0% | |

| Other Charges | Loading Fee/Currency buying Fee | 0% |

| Loading Fee/Currency buying Fee | 0% | |

| Money in Savings Account | Interest Earned | 7% + p.a. |

| Supported Currencies | 130+ currencies, works in 180+ countries |

Offers from Major Brands

You can avail offers from the major brands across the globe.

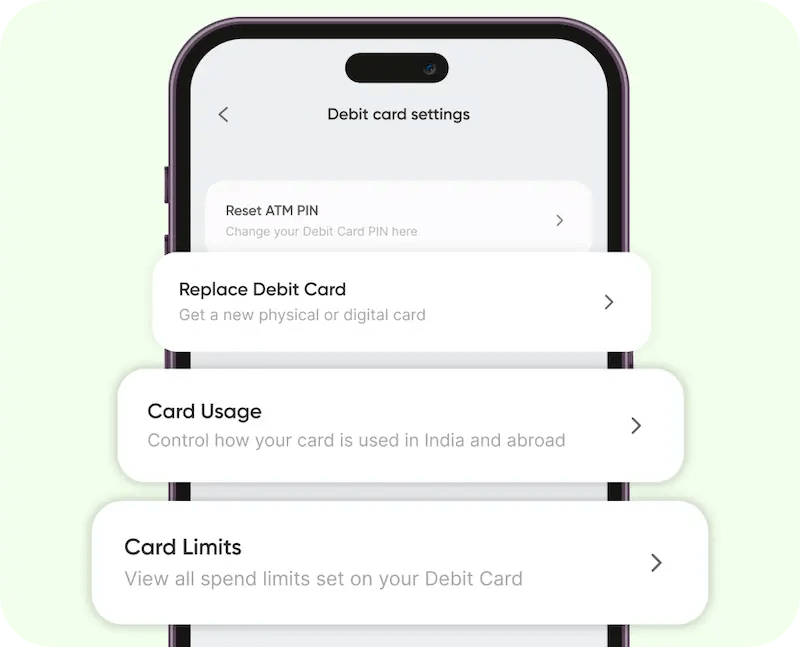

Total Control, All Yours

Take full charge of your finances with complete control at your fingertips. Whether you need to adjust transaction limits, enable global payments, or freeze everything with a single tap, the power is entirely yours. Effortless control, whenever you need it.

Fi-Federal Debit Card is issued by Federal Bank in Partnership with Fi-Brand Limited.

In partnership with

Multiple Plans to select from

This debit card comes with 3 different types of plans: Plus, Infinite and Standard. Each plan comes with different sets of fees and charges.

Conclusion

In conclusion, the Fi-Federal Debit Card offers a seamless and convenient way to manage your money with added benefits like easy global transactions and complete control over your spending. Whether you’re making everyday purchases or handling bigger transactions, this card provides the flexibility you need.

If you’re looking for a simple, secure, and efficient debit card solution, the Fi-Federal Debit Card is definitely worth considering. It’s designed to make banking hassle-free and empowering—just what you need in today’s fast-paced world!

You can read other interesting posts here:

FAQs

Do I receive a physical debit card automatically after signing up for Fi?

No, a physical debit card isn’t automatically issued when you sign up. You’ll need to order it separately, but the process is quick and simple:

* Go to the “Request New Card” section

* Tap on ‘Request for New Card’

* Verify your communication address

* Hit ‘Order the Card’ to complete the process.

How can I activate my debit card?

To activate your debit card, simply scan the QR code found on the card’s box. Open the Fi app, tap the QR code icon on the home screen, and scan the code to complete the activation process.